ONS Labour Market August 2022

Vacancies slow for first time in nearly two years

- The number of job vacancies in May to July 2022 was 1,274,000 – a decrease of 19,800 from the previous quarter – the first fall since June to August 2020.

- Administrative and support activities and Construction showed the largest decreases in vacancies on the quarter at 8,700 and 6,700 respectively.

- The total number of vacancies was 478,800 (60.2%) above the January to March 2020 pre-pandemic level.

- The ratio of vacancies for every 100 employee jobs fell to 4.2 in May to July 2022, the first fall since April to June 2020.

Payrolled employees rise

- Early payroll estimates for August show the number of payrolled employees rose by 847,000 employees (2.9% YoY) to 29.7 million.

- On the previous month, the number of payrolled employees rose by 0.2% (73,000).

- This is up 649,000 on the pre-Covid level, with the number of payrolled employees up by 2.2% since February 2020.

- The largest yearly increase in payrolled employees continued to be in accommodation and food services (a rise of 140,000 employees), while the smallest remained in the construction sector (a fall of 5,000).

Unemployment increased 0.1pp on the quarter

- The unemployment rate for April to June increased by 0.1pp on the quarter to 3.8%. Notably, those unemployed for between 6 and 12 months increased for the first time since February to April 2021.

- The economic inactivity rate was unchanged at 21.4% in April to June 2022. An increase in the number of people who were economically inactive owing to long-term sickness, was largely offset by a decrease in those economically inactive for “other” reasons.

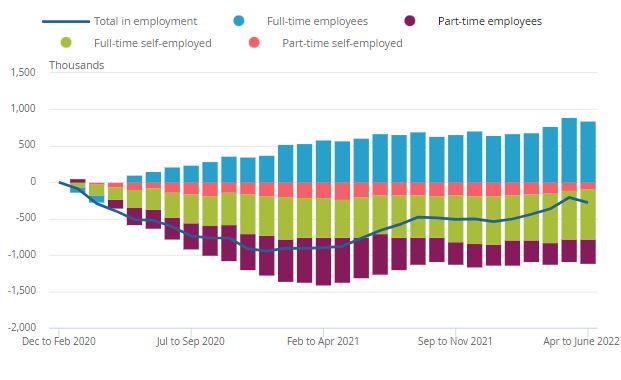

Employment rate dips

- The employment rate decreased by 0.1pp on the quarter to 75.5% but is 1.0pp below pre-pandemic levels.

- The number of full-time employees increased over the quarter while part-time employees recorded a slight decrease during the latest period.

UK employees and self-employed workers, full-time and part-time workers, aged 16 years and over, seasonally adjusted, cumulative change from December 2019 to February 2020, for each period up to April to June 2022

Source: Office for National Statistics

Fall in hours worked

- Total actual weekly hours worked decreased by 0.8 million hours compared with the previous quarter to 1.04 billion hours in April to June.

- This is still 9.5 million below pre-pandemic levels (December 2019 to February 2020). But total actual weekly hours worked by women continue to exceed pre-coronavirus pandemic levels.

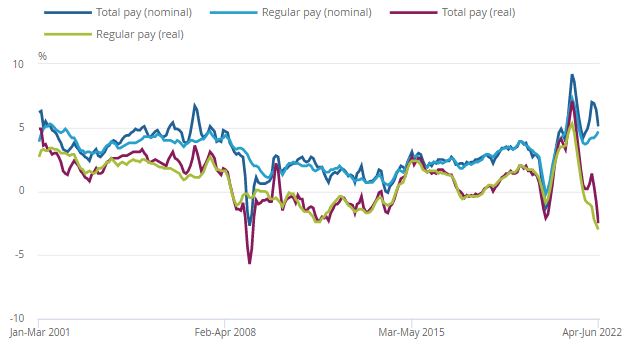

Inflation outpaces earnings

Both annual total and regular pay growth lagged inflation in the three months to June.

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £568 per week before tax and other deductions from pay – up from £540 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £611 per week before tax and other deductions from pay – up from £576 per week a year earlier.

- Regular and total pay growth rose by 4.7% and 5.1% respectively in the three months to June compared to a year earlier.

- Average total pay growth for the private sector was 5.9% in April to June 2022, three-times higher than in the public sector (+1.8%). The wholesaling, retailing, hotels and restaurants sector saw the largest growth rate at 7.7%, followed by the finance and business services sector and construction sector, both at 6.3%, partly reflecting strong bonus payments.

- In real terms (adjusted for inflation), total pay declined by 2.5% in the three months to June, while regular pay declined by 3.0% over the period – a record decline.

Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to April to June 2022

Source: ONS

Back to Retail Economic News