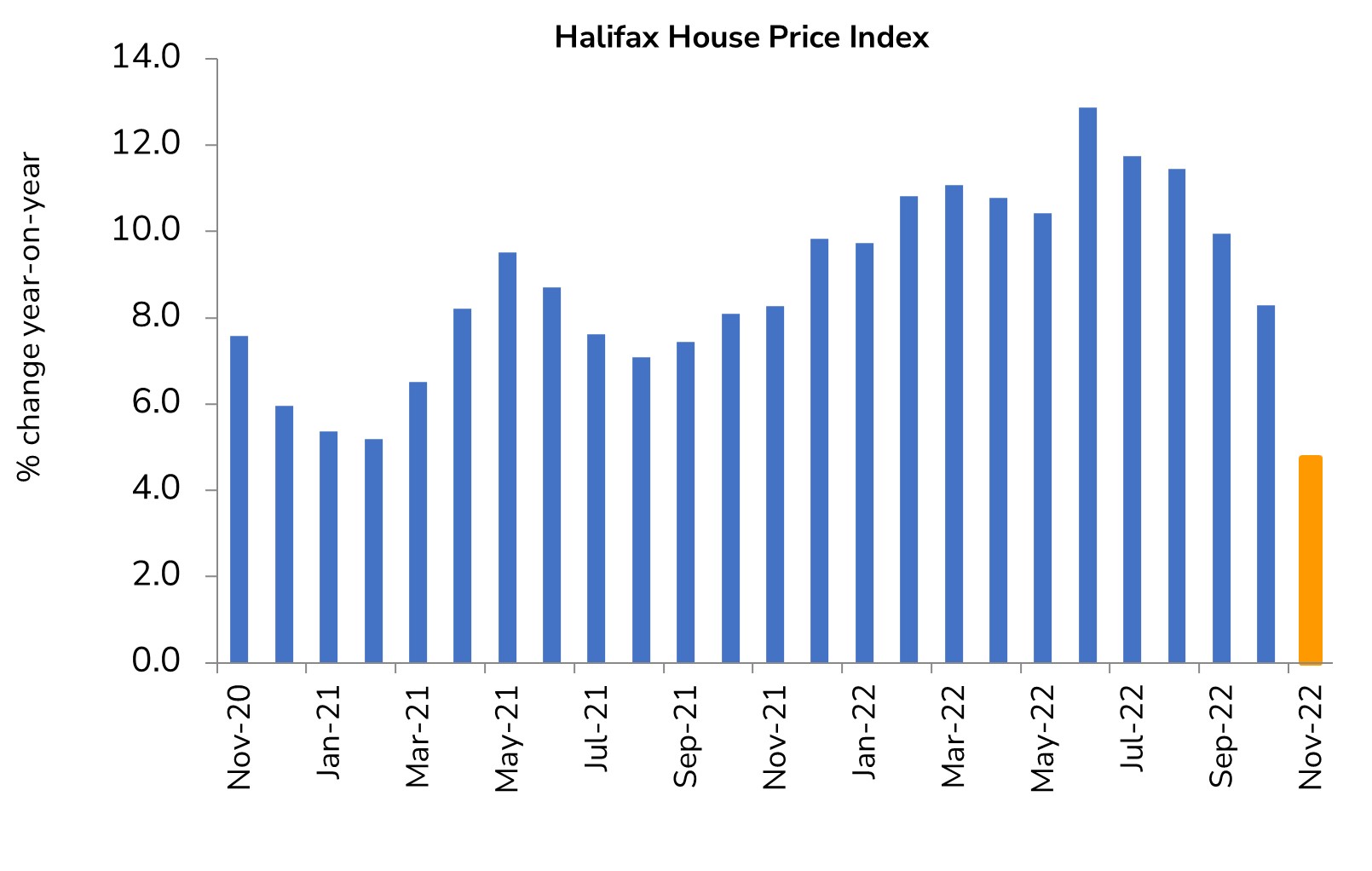

Halifax House Price Index November 2022

- UK house prices increased 4.7% YoY in November according to mortgage lender Halifax.

- On a monthly basis, prices fell by 2.3% in November (vs -0.4% in October).

- The average UK property now costs £285,579 (down from £292,406 in October)

House prices coming down from peak

Source: Halifax, IHS Markit

Key trends

- The annual rate of house price growth eased to 4.7%, from 8.2% in October, indicating that the housing market has entered a slower period.

- The monthly fall in house prices of 2.3% is the sharpest since October 2008, and the third consecutive fall, taking the average property price to £285,579.

- All regions saw annual house price growth slow in November except for the North East, which saw its rate of annual growth increase slightly to 10.5% (up from 10.4%).

- Wales (7.9%) and the South West (8.4%), both key hotspots of house price inflation during the pandemic, saw the sharpest slowdown in growth from 11.5% and 10.7% respectively.

- London continues to lag other UK regions, and the rate of annual house price inflation in the capital rose again by 5.2% in November, down from 6.6% in October. With a typical house price of £549,160, however, the average property price is London continues to be significantly higher than those in other parts of the country.

Outlook

- November saw the largest monthly drop in average house prices since October 2008, reflecting the worst of recent market volatility.

- Many potential home moves have been put on hold as rising living costs and the prospect of mortgage rate increases continue to erode buyer confidence.

- The limited supply of properties nonetheless continues to put upward pressure on house prices, which remain £12,000 higher than November 2021.

- The outlook for house prices will depend heavily on the trajectory of mortgage rates and household finances against a harsh economic backdrop.

- While current joblessness is at a historic low, an increase in unemployment in the event of a recession will also be a key determinant of house price performance over 2023.

Back to Retail Economic News