Despite online shift accelerated by pandemic, consumers still value the ‘touch and feel’ of physical retail

This article is part of a four part mini-series, taken from our report "The Retail Experience Economy 2.0", which focuses on how the Retail Experience Economy will need to adapt after Covid-19. Find the other three parts at the bottom of this page

5 minute read

As we emerge from the pandemic, there are a number of aspects of our lives as consumers that have changed irreversibly, others that have stayed the same, and others still that have either intensified or diminished in and value.

Retail Economics maintains a key interest in the Experience Economy, having looked closely at the four realms of experience in collaboration with Squire Patton Boggs in 2019. Our most recent report on the matter, “The Retail Experience Economy 2.0: Adapting to a New Landscape”, looks at how each of the four realms of the consumer experience previously identified (Environment, Entertainment, Escapism and Education) have been impacted by a year and a half of Covid restrictions.

The closure of non-essential retail during periods of lockdown necessitated the shift to online. Consumers were faced with new digital-first customer journeys, having to overcome barriers of trust and the initial friction of setting up online accounts. Retail Economics research found that almost half (45%) of shoppers have bought goods online during the pandemic that they previously only ever purchased in-store.

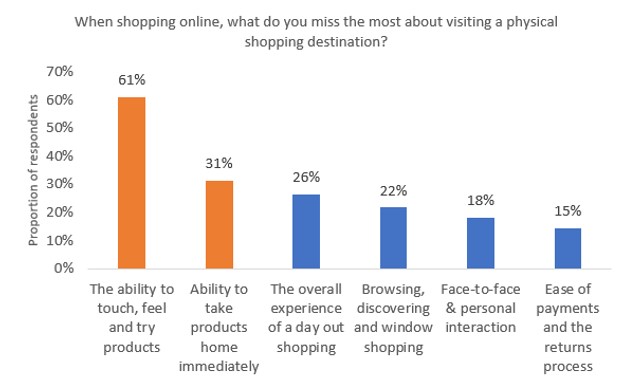

However, this doesn’t mean that the focus has swung irreversibly towards e-commerce – far from it. Our research shows that 61% of consumers that shop online miss the ability to touch, feel and try on products, while over a quarter (26%) miss the overall experience of physical shopping.

This suggests that for many consumers, online shopping is more a functional and convenience-led activity, and not necessarily an enjoyable experience. For more emotive purchases where shoppers want to get hands-on with products before they buy, the in-store experience is essential.

Fig 1: 61% of consumers miss touch and feel the most compared to online

Source - Retail Economics