3. Distribution hubs

The shift to e-commerce demands speed, agility and flexibility, and physical stores can play a pivotal role in achieving this.

By leveraging stores as micro-distribution centres, retailers and brands can implement faster and more convenient delivery solutions for customers, while simultaneously relieving supply chain pressures and utilizing in-store stock more efficiently.

Levi’s was among several retailers that used its closed stores to fulfil online orders during the pandemic, helping speed up delivery times and preventing overcrowding in its distribution centres.

The pandemic will accelerate the rise of ‘grey’ or ‘dark’ stores that mimic normal store operations but are more akin to a walk-in fulfilment hub, geared up for collection and returns.

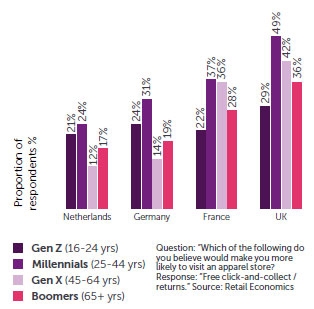

Click-and-collect services surged during the pandemic. Our research shows that consumers expect to increasingly use this service going forward. Around a quarter (24%) of European consumers said they are more likely to visit an apparel store if they offer free click-and-collect, and returns.

Across each of the four European markets surveyed, click-and-collect is most popular amongst Millennials (25-39 yrs). This age group finds it convenient to collect an order as part a work commute or school run, rather than risk being out and missing a home delivery. Almost half (49%) of UK Millennials are more likely to visit an apparel store if they offer free click-and-collect (Fig 14).

Fig 14: Covid-19 has boosted demand for click-and-collect

Question: “Which of the following do you believe would make you more likely to visit an apparel store? Response: “Free click-and-collect / returns.” Source: Retail Economics

4. Personalisation

Today’s consumers crave unique and personalized shopping experiences. In a crowded marketplace, personalization is a key differentiator which retailers and brands can develop to gain a competitive advantage.

Personalization is particularly important for apparel where customer journeys are often complex and rarely linear. Each shopper has their own individual style and preferences, and the path to purchase often spans multiple devices and channels – online and offline. Personalization is a potent sales tool, offering superior leverage for conversion.

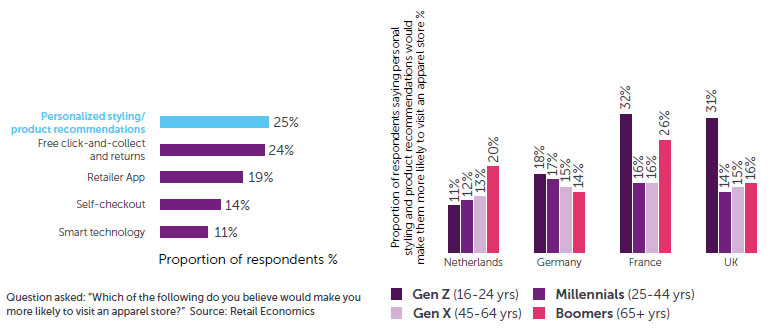

Our research shows that highly personalized services are a key pull factor for physical stores. One in four European shoppers said they would be more likely to visit an apparel store if they offer personal styling and bespoke product recommendations (Fig 15).

Fig 15: Personalized service valued highly by Gen Z consumers

Question asked: “Which of the following do you believe would make you more likely to visit an apparel store?” Source: Retail Economics

Personalization is valued most by Gen Z (16-24 yrs) consumers who enjoy being able to customize products. Personalized offerings, such as Spotify playlists and Netflix recommendations, already play a key role in their everyday consumption; and they increasingly seek a similar personalized experience from retailers and their stores.

5. Meaningful experiences

After more than a year, European consumers seek to rediscover the pleasures of physical shopping and the positive experiences it provides. With social events back on the agenda and consumers eager to refresh wardrobes, opportunities abound for apparel retailers to tap into this pent-up demand.

But if retailers are to be successful in enticing customers back into stores, they must go beyond the transactional and strive to deliver positive experiences. Physical stores can act as ‘playgrounds’ for consumers by generating interest and creating brand buzz.

Retail Economics research found that entertainment was the most important aspect of a meaningful retail experience for consumers, chosen by two in five shoppers (40%). The fusion of entertainment and retail is likely to take on new heights in a post-pandemic world as physical stores reposition themselves as destinations of discovery. Here, entertainment can include in-store workshops, glitzy fashion shows, and celebrity appearances amongst others.

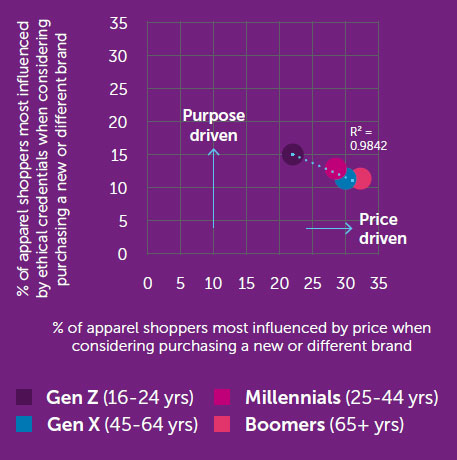

Social values are also dovetailed into retail environments as brands showcase their ESG principles. Younger shoppers are particularly attuned to ethical credentials. When choosing an apparel brand, our research shows that Gen Z (16-24 yrs) consumers are motivated less by price and more by social value; whereas older age groups consider price to be a more influencing factor (Fig 16).

Fig 16 - Younger shoppers are more purpose-driven, less influenced by price

Source: Retail Economics

In a post-pandemic era, success within apparel retail rests on a complex balance of fusing physical and digital realms, with stores reimagined and repurposed, leveraging technology and authentic customer relationships predicated on robust ESG credentials.

Given Gen Z consumers represent the future path of retail, apparel retailers must continually adapt their proposition and stores to meet the needs of an audience that craves fun and memorable experiences delivered in a meaningful and socially responsible manner.

Conclusion

In conclusion, stores will play multiple roles, from multisensory showrooms where customers can discover and interact with products, to convenient distribution hubs for click-and-collect and returns, while simultaneously integrating digital technologies in-store to offer personalized, yet meaningful, shopping experiences.

Toward the future, innovative in-store design will present customers with a curated range of products that have been preselected, based on their personal preferences and purchase histories. Consumers will also be able to customize in-store features via an app (e.g. music, lighting) which tracks their movement. Shop assistants, human or virtual, will also be available to advise on styles and fulfilment options, prior to purchases being made via mobile or self-checkout.

Things to do now

Explore the first article in this series here which looks at the impact of Covid-19 on the apparel industry and the shift to the online channel.

Download the full report here

Found this

short article interesting?

This article forms part of a thought leadership report entitled “A seamless fit - Evolution of stores in a digital-centric customer journey” produced by Retail Economics in partnership with Eversheds Sutherland. It is the last in a three-part article series which explores five ways in which physical apparel stores are evolving in a digital-first environment. For retailers and brands seeking insight into the impact of the crisis across Europe, the full report provides data-driven insights and guidance for action.

View Full

Report Here