GDP Monthly Estimate: October 2020

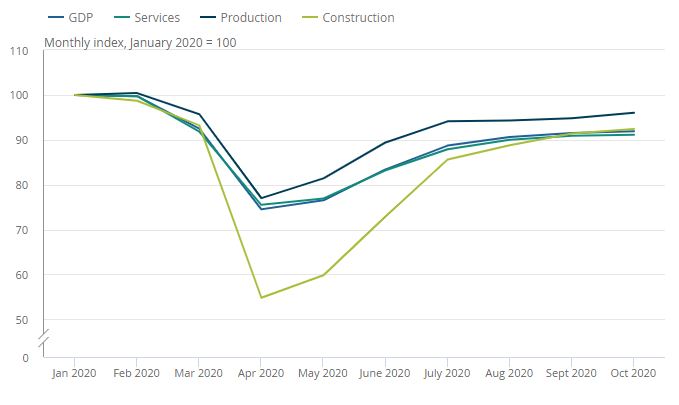

Monthly GDP rose by just 0.4% in October, slowing on the previous month but above market expectations of flat growth. GDP remains 7.9% lower than the level seen before the full impact of the pandemic in February.

All sectors grew in October, with the services sector recording the weakest rise of 0.2% compared with a 1.3% uplift for production and 1.0% rise for construction.

Monthly index, January 2020 to October 2020, January 2020 = 100

Source: ONS

Services

Services output rose by 0.2% on a monthly basis in October, following a 1.0% rise in September. Services output remains 8.6% below the level in February 2020. Growth was recorded in 11 out of the 14 sub sectors but a disappointing performance in accommodation and food services (-14.4%) weighed on growth in October.

On a three-month rolling basis, services output rose by 9.7%. Notably the rise was driven by food and beverage service activities (+1.22 percentage points) due to the inclusion of August’s data which was boosted by the Eat Out to Help Out Scheme. Elsewhere, education (+1.02pp) and wholesale and retail trade (+0.68pp) also supported growth on a three-month rolling basis.

Production

Production output increased by 1.3% in October 2020, with manufacturing growing by 1.7%. Despite the rise, production output remains 4.4% lower than the level in February 2020. Growth was recorded in 11 out of 13 sub-sectors with the largest contribution coming from the manufacture of transport equipment which rose by 5.4% in October 2020.

In the three months to October, production output rose by 7.6%. Three out of four sub-sectors recorded a rise: manufacturing (+10.0%), electricity, gas, steam and air conditioning supply (+5.3%), and water supply (+3.0%).

Construction

Construction output rose by 1.0% on a month-on-month basis in October, slowing on the previous month. This was driven by components of repair and maintenance which recorded positive growth in October, notably in public other new work and non-housing repair and maintenance, which grew by 7.5% and 5.1% respectively. At the other end of the spectrum, private new housing fell by 1.9%, weighing on overall growth.

Construction output rose by 24.9% in the quarter to October, driven by private new housing.

Back to Retail Economic News