GDP Monthly Estimate: May 2021

UK economic activity slowed in May, despite the reopening of indoor hospitality as Covid-19 restrictions eased. GDP is estimated to have grown by 0.8% in May, the fourth consecutive month of growth, but this was considerably slower than March (2.4%) and April (2.0%). Economic activity remains 3.1% below pre-pandemic levels of February 2020.

The services sector grew by 0.9% in May 2021 – with accommodation and food services rising by a massive 37.1% as restaurants and pubs welcomed customers back indoors.

The construction sector contracted for a second consecutive month in May (-0.8%), impacted by unseasonably wet weather, but remains 0.3% above its pre-pandemic level. Meanwhile, manufacturing growth stalled, as UK carmakers struggled due to a shortage of microchips, with the manufacture of transport equipment falling by 16.5%.

While the latest figures confirm the rebound in economic activity continued in May, the marked slowdown in growth suggests that the recovery is losing some steam as the temporary boost, from earlier phases of the economy reopening, fades.

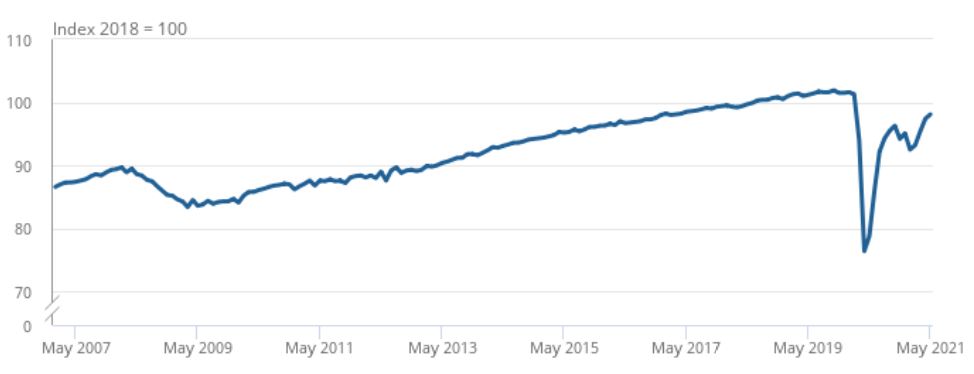

UK GDP rose for a fourth consecutive month in May, up 0.8%, but remains 3.1% below its pre-pandemic level

Monthly GDP index, January 2007 until May 2021, 2018 = 100. Source: ONS

Services

Services output underwhelmed in May, growing by a relatively modest 0.9% month-on-month. The main drag on services came from transport as Covid-19 restrictions continue to hit the travel industry, particularly aviation.

Food and beverage activities were the main driver of services growth in May, up 34.0% month-on-month, as pubs and restaurants were permitted to serve customers indoors. The industry remains 9.4% below its pre-pandemic level (February 2020), but 0.3% above its August 2020 peak when the Eat Out to Help Out Scheme boosted consumer demand.

Interestingly, the easing of hospitality restrictions had a negative impact on retail sales, particularly food sales (which make up 39% of retail sales), as consumers returned to restaurants, bars, and cafés instead. Sale volumes from predominantly food stores fell by 5.7% in May 2021, compared with total retail sales falling by 1.4%.

Overall, services output grew by 3.9% on a three-month rolling basis, driven by a recovery in retail sales, the return to schools boosting education output, and strong demand for pubs and restaurants. However, Services output is still 3.4% below its pre-pandemic level of February 2020.

Production

Production output grew by 0.8% in May, with mixed growth across the four sectors. The sector is 2.6% below its February 2020 pre-pandemic level.

The Manufacturing sector was broadly flat, contracting slightly by 0.1%. The largest downward contribution came from the manufacture of transport equipment (-16.5%) as microchip shortages disrupted car production.

Electricity, gas, steam and air conditioning supply grew by 5.7% in May 2021, and was the primary growth driver in production output. This is the largest growth for energy and utilities since April 2012, mainly resulting from adverse weather conditions in May which led to significantly higher demand than normal for this time of the year.

Overall, in the three months to May, production output increased by 0.8%, led by manufacturing of food and beverage products and machinery, and partly offset by a large drop in mining and quarrying activity in April.

Construction

Construction dropped for a second consecutive month, falling 0.8% in May, following exceptionally strong growth in the first quarter of the year. Despite this, construction remains the only sector that has fully recovered, with output above pre-pandemic levels.

The fall in construction output in May reflected a drop in repair and maintenance (-1.6%) and new work (-0.3%).

Anecdotal evidence received from survey returns suggested adverse weather conditions - the fourth wettest May on record - were a contributing factor to the fall, as businesses lost working days.

Overall, on a three-month rolling basis, construction output grew by 6.3% in May, with the sector benefitting from a rise in home building activity and public sector infrastructure projects in the first quarter of the year.

Source: ONS

Back to Retail Economic News