RICS Residential Market Survey September 2022

Buyer enquiries fall again

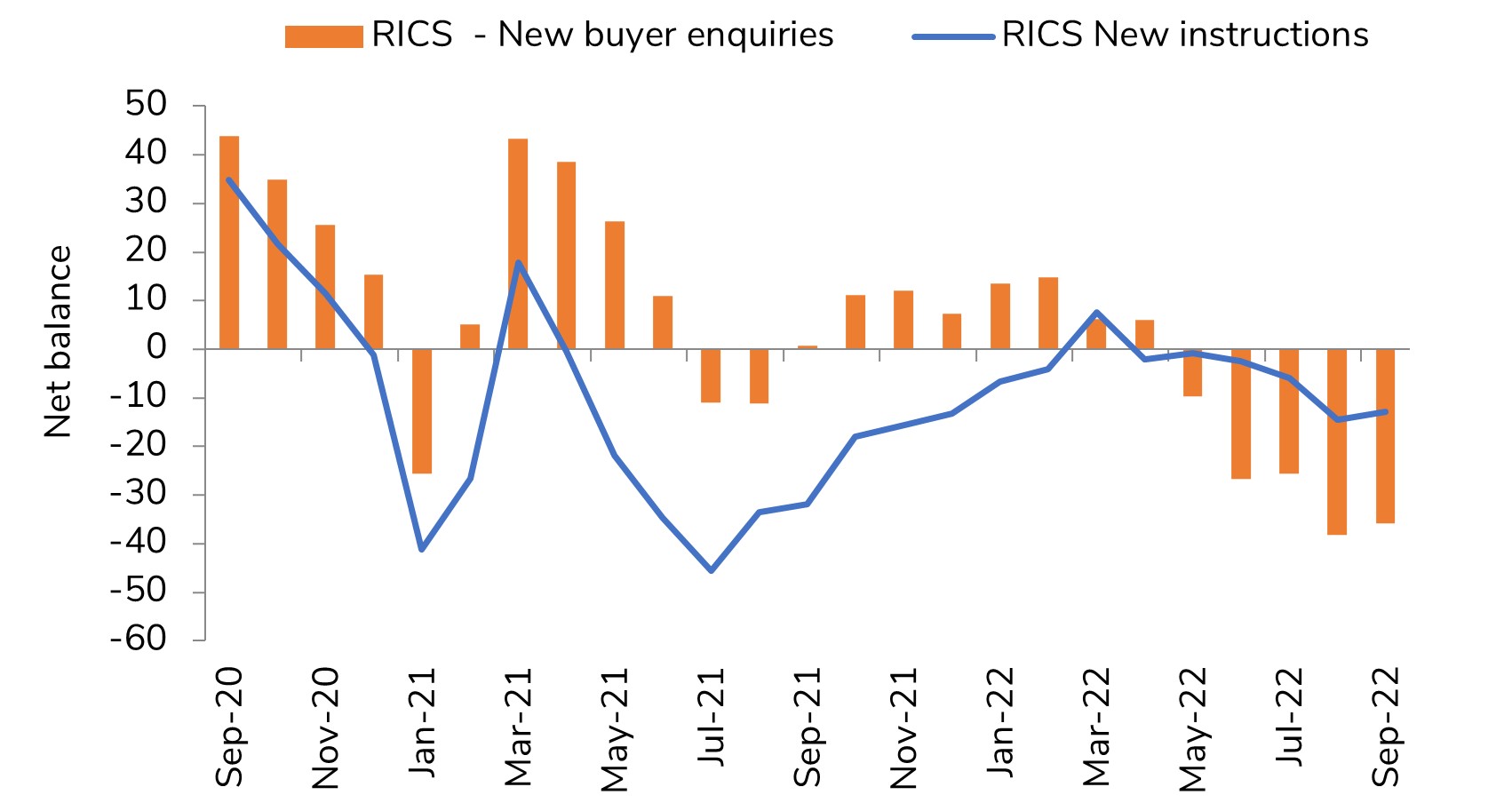

- The RICS UK Residential Survey for September results point to the sales market continuing to lose momentum, with the outlook for interest rates and the uncertain economic outlook taking a toll on market activity.

- The net balance for new buyer enquiries registered -36%, down from -28% in August.

- As such, buyer enquiries have now fallen in each of the last five months, with all regions/countries of the UK seeing a downward trend coming through.

- In terms of agreed sales, a net balance reading of -27% was posted in September, representing the softest reading for this series since May 2020, having fallen deeper into negative territory for five months in succession.

Inventory levels at fresh record low

- With respect to new instructions, the latest net balance of -13% points to a continued decline, little changed from last month’s value of -15%.

- As a result, stock levels on estate agent’s books (on average) sunk to a fresh all-time low of just 34 homes in September.

- Furthermore, the net balance for market appraisals dropped to -20%, down from -3% at the last point of measurement, suggesting that the supply pipeline has deteriorated further.

Residential market indicators subdued

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Pace of price growth easing

- With respect to house prices, although the latest national net balance of +32% is indicative of a continued increase in prices over the three months to September, it does represent a noteworthy easing in the pace of growth (down from a read of +51% beforehand).

- Price growth (in net balance terms) has now moderated to some degree in five successive months, following a recent high of +78% recorded in April this year.

- Nevertheless, prices remain in expansionary territory across the UK, though the latest results point to a significant easing of price growth.

Outlook

- Near-term sales expectations remain stuck in negative territory, at -30% in September, down from -26% in August.

- Over the next twelve months, a national net balance of -39% of respondents foresee sales slipping. This is marginally less pessimistic than last month’s reading of -45%, but still significantly downbeat.

- Price expectations for the next twelve months have now turned negative after a net balance of +3% last month. Respondents cite the expected further substantial rises in mortgage rates as a factor putting pressure on the market over the year ahead.

- This indicates a flat projection for national house prices over the twelve-month time horizon.

- At the national level, -18% of respondents envisage a fall in prices over the next twelve months, down from the previous reading of +3%.

Rental market

- Tenant demand picked up according to a net balance of +42% of contributors.

- On the supply front, a net share of -13% of respondents noted a decline in new landlord instructions, a figure identical to last month’s reading.

- As a result, near-term expectations point to further strong growth in rental prices over the coming three months.

- However, the latest reading is slightly more modest in comparison to that seen a couple of months prior (net balance 44% vs +58% back in July).

Back to Retail Economic News