RICS Residential Market Survey September 2021

Demand stabilising

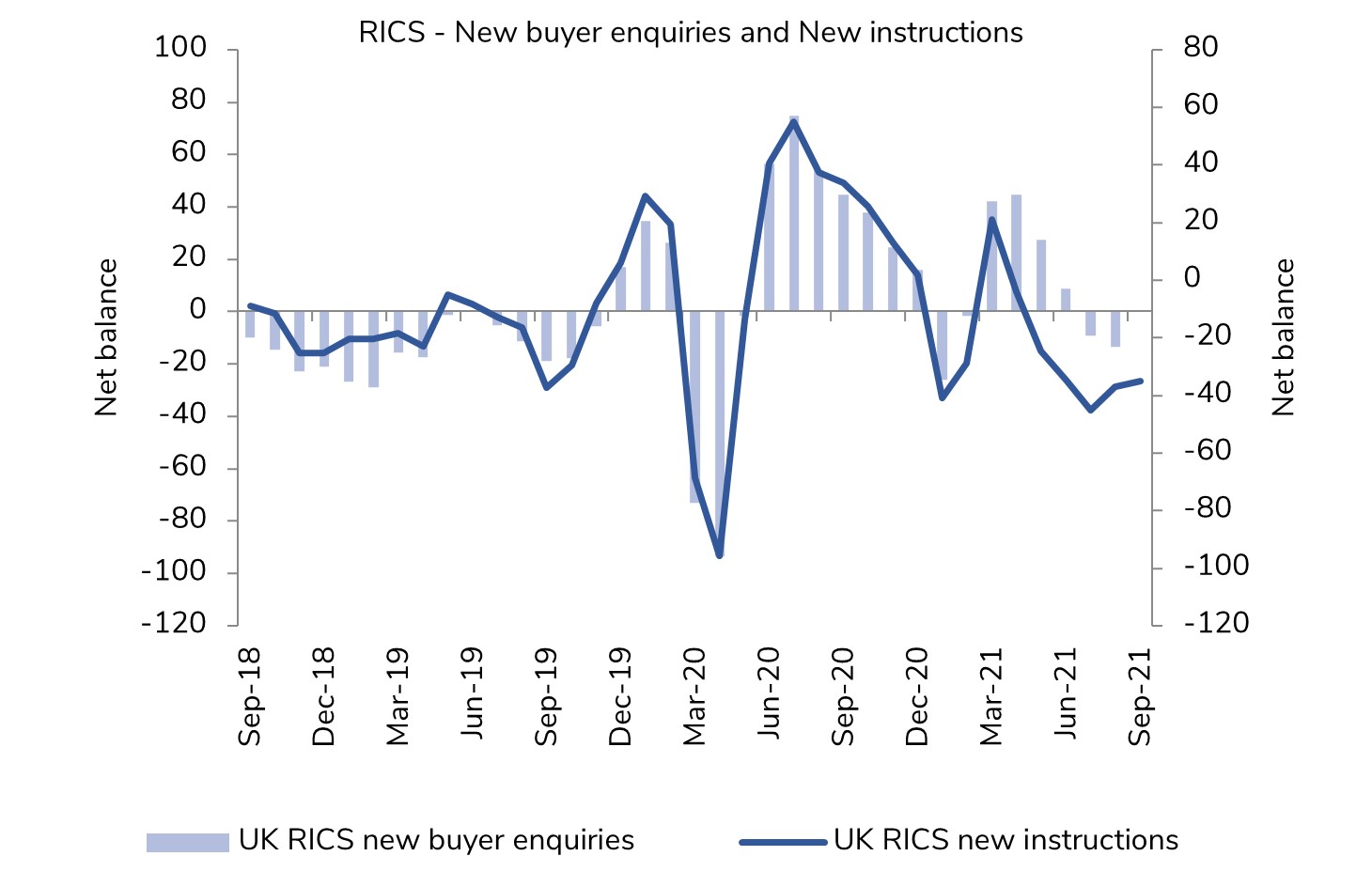

- The RICS UK Residential Survey for September shows a steadier trend in buyer demand, after a brief pull-back in August.

- The measure for new buyer enquiries recorded a net balance reading of 0, indicating a steady demand backdrop and an improvement on the -13

- Agreed sales slipped back in September for the third month in a row, evidenced by a net balance of -15% of respondents citing a decline (compared to -17% in August).

Lack of supply

- The recent decline in new properties coming to market shows little sign of abating.

- September’s measure for new listings came in at -35% and has now been in negative territory in each of the last six months.

- In another indication of the constrained supply picture, respondents also report that the number of appraisals undertaken during September was below the rate seen twelve months prior, with the net balance dropping to -26% from -10% back in August.

Prices to keep rising

- The lack of available stock on the sales market is creating competition amongst buyers, thereby sustaining upward pressure on house prices.

- At a national level, a net balance of +68% of survey respondents noted a rise in house prices in September.

- While this has eased from a recent high of +82% seen in May, the latest reading remains elevated when placed in a historical context.

- In terms of the outlook for prices, a net share of +21% of respondents anticipate prices will continue to increase over the coming three months (marginally down on +23% in August).

- For the next twelve months, a national net balance of +70% of agents anticipate prices will be higher in a year’s time, putting expectations firmly in expansionary territory.

Sales expectations firm

- Near term sales expectations improved slightly in September, with a net balance of +11% of agents expecting sales activity to rise over the next three months (up from +6% in August).

- This suggests a positive picture for residential transactions through the rest of 2021, albeit not at the same levels of activity seen over the last twelve months.

- The twelve-month sales expectations reading sits in neutral territory, pointing to a largely stable trend in sales activity over the year ahead.

London rental market turnaround

- In the lettings market, tenant demand appears to be accelerating. A net share of +62% of respondents reported a rise in rental enquiries in September.

- At the same time, landlord instructions remain firmly negative (-21%) as has been the case since July 2020.

- The imbalance between robust tenant demand and a scarcity of available rental properties is set to drive rents higher going forward. A net balance of +55% of agents anticipate headline rents to be higher in three months’ time.

- At the twelve-month time horizon, respondents’ projections point to headline rental growth of just over 3%.

- In London, rents are now expected to rise by circa 2% on the same basis, a significant turnaround relative to six months ago, when rental projections were in negative territory.

Housing market activity stabilises in September

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Back to Retail Economic News