RICS Residential Market Survey October 2022

Sharp decline in buyer enquiries

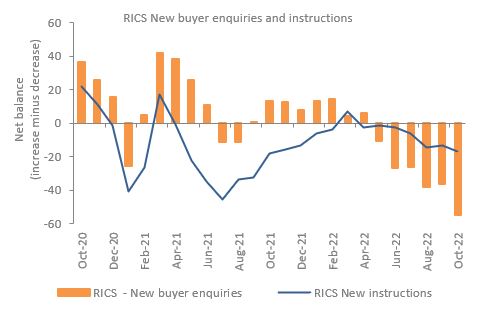

- The RICS UK Residential Survey for October results point to a further deterioration in market conditions, as buyer demand and agreed sales continue to fall.

- The net balance for new buyer enquiries weakened further to -55%, down from -36% in September.

- As such, buyer enquiries have now fallen for the sixth successive month, with all regions/countries of the UK seeing a downward trend coming through.

- In terms of agreed sales, a net balance reading of -45% was posted in October, down from an already low reading of -29% in September.

Inventory levels at record low

- With respect to new instructions, the latest net balance of -17% points to a continued decline, down from last month’s value of -13%.

- Furthermore, the net balance for market appraisals dropped to -37%, down from -20% at the last point of measurement, suggesting that the supply pipeline has deteriorated further.

Residential market indicators weakening

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Price growth stagnating

- The latest house price data show a clear slowing in momentum as the national net balance for house prices moderated to -2% in October, down sharply from +30% in September.

- This is the first negative reading in 28 months, indicating that house price growth is stagnating.

- Some areas of the UK, such as East Anglia and the South East are experiencing significant pull-back in prices, recording net balances of -31% and -16% respectively. On the other hand, Northern Ireland and Scotland continue to report an upward trend in house price growth, albeit softer than a year ago.

Outlook

- Near-term sales expectations have slipped deeper into negative territory, at -40% in October, down from -31% in August.

- Over the next twelve months, a national net balance of -42% of respondents foresee sales slipping, broadly in line with September’s reading of -44%.

- Price expectations for the next twelve months have dropped substantially to -42% after a net balance of -18% in September

- Respondents across all parts of the UK envisage that prices will see some degree of decline over the next year.

Rental market

- Tenant demand continues to rise according to a net balance of +46% of contributors, up from +42% in September.

- On the supply front, a net share of -14% of respondents noted a decline in new landlord instructions, similar to last month’s reading of -13%.

- As a result, near-term expectations point to further strong growth in rental prices over the coming three months.

- However, the latest reading is slightly more modest in comparison to that seen a couple of months prior (net balance +52% vs +55% in the last quarter).

Back to Retail Economic News