RICS Residential Market Survey November 2021

Dearth of new instructions

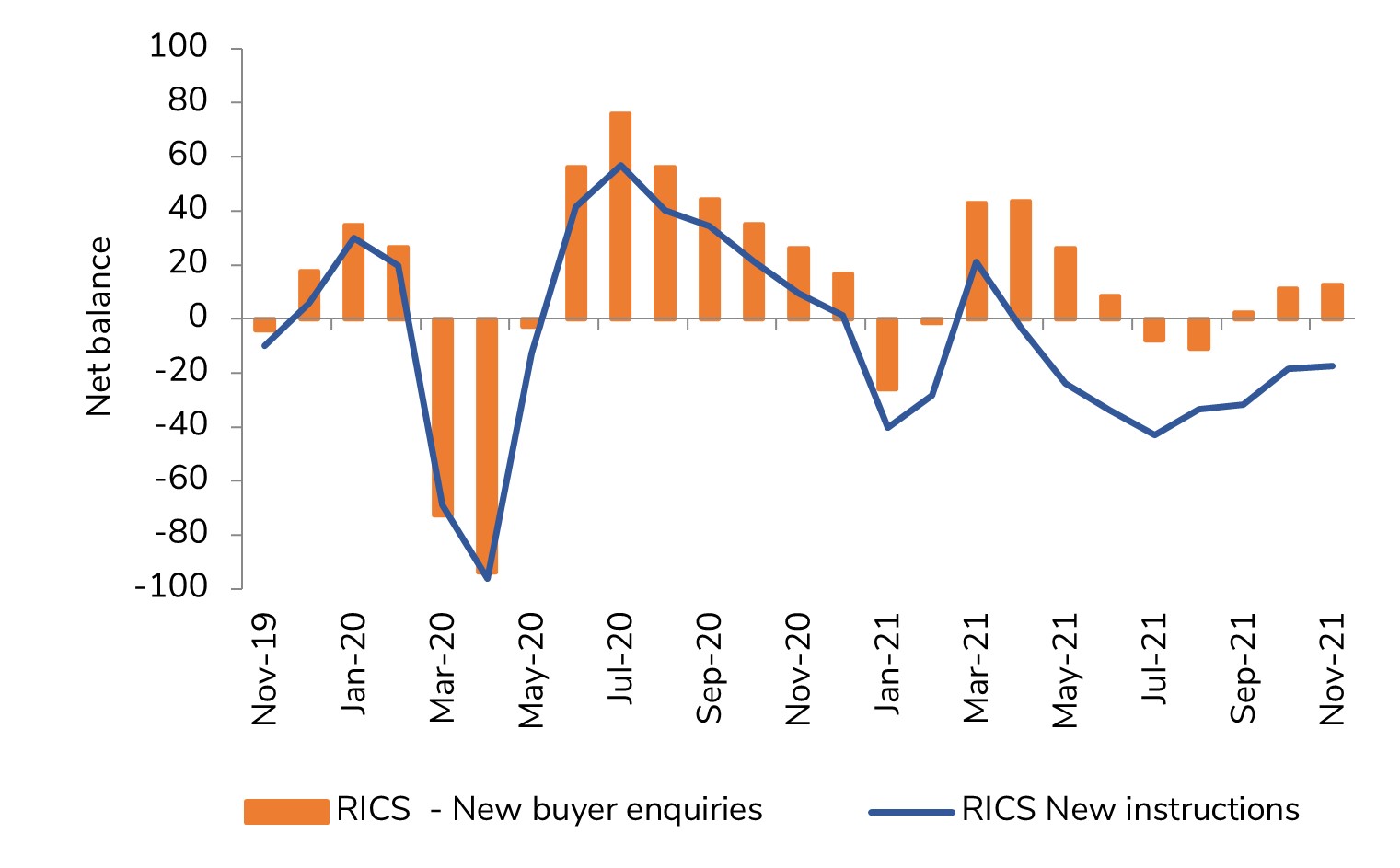

- The RICS UK Residential Survey for November shows a continued lack of new instructions is holding back market activity.

- November’s measure for new instructions came in at -18%, the eighth consecutive negative monthly reading.

- The volume of market appraisals undertaken in November was also reportedly below the level seen in the same month a year ago.

House prices keep rising

- The lack of stock available on the market is sustaining competition amongst would-be buyers, with the upshot being that house prices continue to be pushed higher.

- At a national level, a net balance of +71% of survey respondents noted a rise in house prices in November. This is identical to October’s reading, with house price inflation remaining consistently strong despite the withdrawal of stamp duty relief at the end of September.

- In terms of the outlook for prices, a net share of +66% of respondents anticipate prices will continue to increase over the year ahead, with this measure showing little sign of easing.

Enquiries up, sales down

- New buyer enquiries picked up slightly in November, with a net balance of +13% of agents noting an increase (up from +11% in October).

- But, agreed sales fell for the fifth month in a row, shown by a net balance of -9% of respondents reporting a decline in November (compared to -7% in October).

- Cooler sales activity in recent months follows extremely strongly growth over the last year before the Stamp Duty tax holiday was phased out.

Lack of available properties holding back housing market

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Steady outlook

- Near term sales expectations are holding firm, with a net share of +15% of agents expecting sales activity to rise over the next three months (up from +10% previously).

- Further ahead, the twelve-month sales expectations also ticked higher in November, at 12% (compared to just +4% in October).

- This suggests a positive picture for residential transactions in 2022, albeit not at the same levels of activity seen over the last eighteen months.

Rental market

- In the lettings market, tenant demand remains solid. A net share of +48% of respondents reported a rise in rental enquiries in November.

- Yet, landlord instructions continue to fall, according to a net balance of -24% of agents.

- This mismatch between supply and demand is set to drive rents higher. A net balance of +49% of agents anticipate headline rents to be higher in three months’ time.

Back to Retail Economic News