RICS Residential Market Survey November 2019

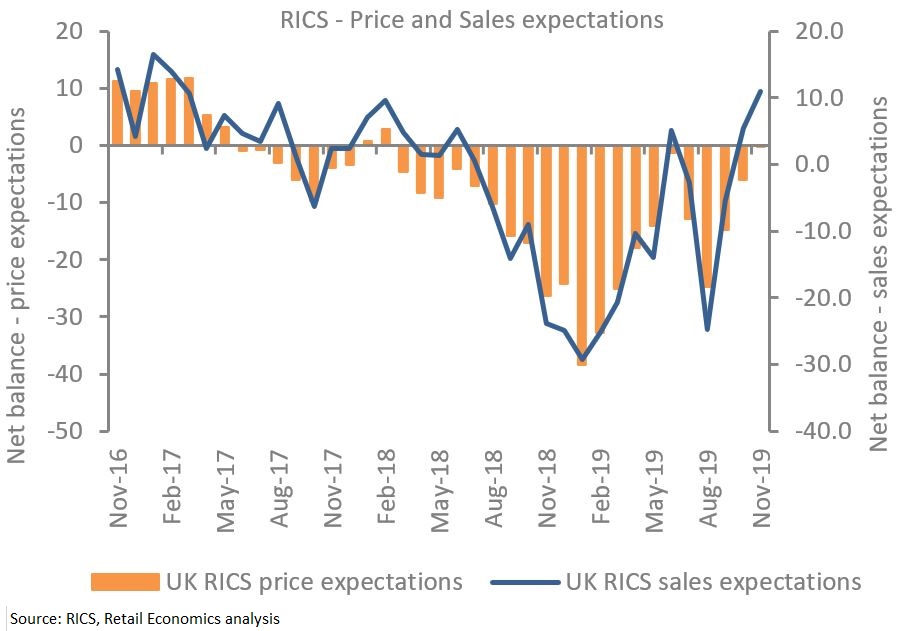

The drop in house sales reported in RICS’s this morning appears to be bottoming out, with the proportion of surveyors who expect a rebound over the next year rising to its highest level since February 2017. Currently however, RICS data suggests the market is on hold as homeowners and buyers anticipate election results and clarity around Brexit.

Limited choice and demand

RICS’s November Residential Survey shows that new instructions to sell homes continued to dip, seeing average stock levels on estate agents' books remain close to record lows at some 41 properties per branch.

Limited choice on the market saw new buyer enquires slip back for a third consecutive month in November, with a net balance -9% of respondents citing a decline.

The lack of appetite from buyers and sellers alike has seen broadly flat house price growth in recent months. Although last week Halifax reported that house prices ticked up 2.1% in November – a seven-month high – RICS reported a seven-month low in its headline price indicator. A net balance of -12% of respondents reported price declines, with RICS’s price indicator being dragged by negative trends across London, South East and East Anglia.

Optimism for 2020

Further out, many expect prices to pick up, with 33% more respondents anticipating in November that house prices will rise over the next year. Crucially, prices are expected to return to growth across all areas of the UK, with Wales and Northern Ireland leading the way.

Sales expectations are also looking more positive, with a net balance of +11% expecting rises in the next three months and +35% expecting rises in the next twelve months – the highest level in more than two and a half years.

Robust rents

Meanwhile, the lettings market continues to face declining rental stock at a time when tenant demand is on the up.

A net balance of -29% of contributors reported a fall in landlord instructions while tenant demand remained steady, which is expected to result in a modest rise in rental prices over the coming months.

Back to Retail Economic News