RICS Residential Market Survey March 2021

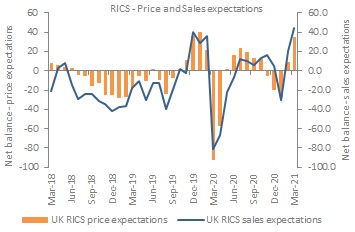

The RICS Residential Market Survey for March shows renewed momentum in market activity, driven by the Stamp Duty Holiday extension. Forward looking indicators on sales expectations and house prices point towards sustained positive growth, at least over the short-term.

Source: RICS

Activity picking up again

- RICS reported that a net balance of +42% of estate agents noted a pick-up in new buyer enquiries in March. This is up from zero in February and marks the strongest reading since September 2020.

- The number of new properties coming on to the market also improved in March, but at a much slower pace of growth, indicating that supply is struggling to keep up with demand.

- That said, a net balance of +29% of respondents noted that appraisals were up on the same period last year (a turnaround on a reading of -19% in February), suggesting the number of new instructions should rise over the next few months.

- Agreed sales rose sharply in March, evidenced by a net balance of +50% of contributors reporting an increase (compared to +7% in February).

Prices head higher

- At a national level, a net balance of +59% of survey respondents cited a rise in house prices over March.

- House prices continue to head higher across all UK regions, with the North West and Yorkshire & Humber reportedly seeing the strongest momentum.

- Prices are expected to remain on a firmly upward trend over the near-term. A net balance of +42% of respondents expect prices to rise further over the next three months (up from +16% previously).

Upbeat outlook over short-term

- Looking ahead, near term sales expectations improved considerably in March, recording a net balance of +35%, compared to just +9% in February.

- This is the most upbeat near-term sales outlook since January 2020 and is a clear reflection of the government’s decision to extend the Stamp Duty Holiday extension by three months to the end of June.

- There is more uncertainty when looking further ahead, with respondents anticipating sales volumes to see more muted growth over the coming twelve months once the stamp duty holiday comes to an end.

- In terms of house prices, the proportion of agents anticipating prices will rise over the year ahead remains extremely positive, with the net balance figure rising to +60% in March, from +46% in February.

Tenant demand building

- In the lettings market, a net balance of +36% of respondents reported a rise in tenant demand in the three months to March (up from +26% previously).

- Yet the number of landlord instructions continues to fall, based on a net balance of -25% of respondents. This indicator has been consistently negative since August 2020.

- Rental growth expectations are strengthening due to this demand-supply imbalance. +47% of agents foresee rents increasing over the next three months.

- London is the only region where rents are not expected to rise over the year ahead, with rental growth projections coming in flat to marginally negative territory, compared to c.3% growth expected at a national level. There is still an oversupply of unlet properties in the capital due to changes in tenants’ preferences as more people work remotely.

Back to Retail Economic News