RICS Residential Market Survey July 2022

Buyer demand declining

- The RICS UK Residential Survey for July shows a further drop in demand, but limited supply continues to underpin house price growth.

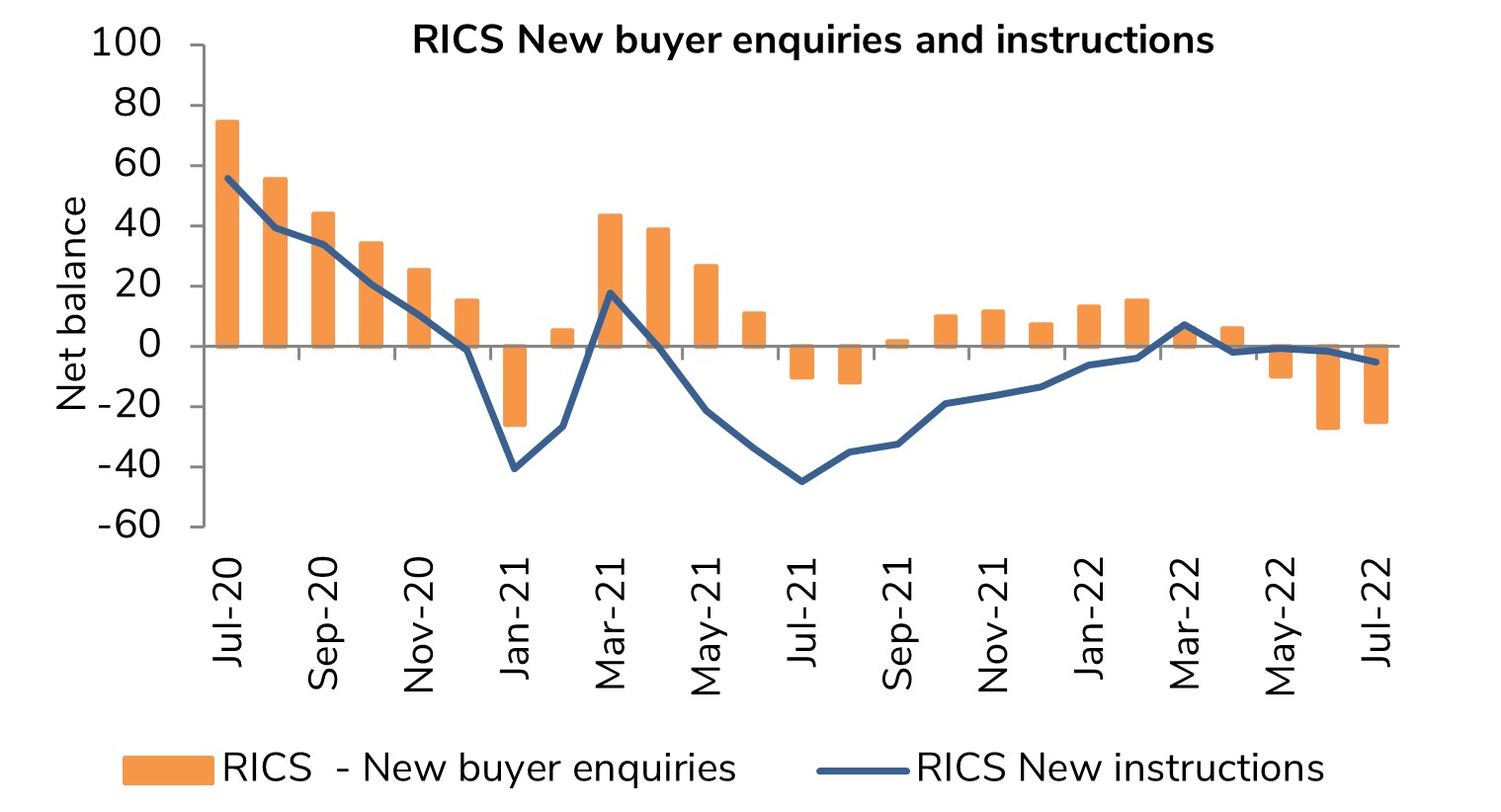

- The net balance for new buyer enquiries registered -25%, broadly in line with the previous month and the third successive negative reading.

- Notably, all UK regions/countries saw a dip in enquiries over the latest period.

- The volume of sales agreed is also falling, evidenced by a net balance reading of -13% (compared with -14% previously).

New listings stagnant

- With respect to new instructions, the latest net balance of -5% points to a largely stagnant trend in the flow of fresh listings coming onto the sales market.

- Average stock levels on estate agents’ books (36 per branch) remain close to an all-time low.

- Respondents have seen little change in the volume of market appraisals being undertaken in compared to twelve months ago.

- This suggests a material pick-up in the supply backdrop is unlikely to emerge in the immediate future

Buyer demand in negative territory

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Prices continue to rise

- At a national level, a net balance of +63% of agents noted a rise in house prices in July, broadly unchanged from +65% in June.

- Although this is somewhat lower than the recent high of +78% seen in the Spring, it remains well ahead of the long-run average of 13%.

- The latest data shows prices continue to rise across all parts of the UK, even if the rate of growth has softened compared with earlier in the year.

Outlook

- Near term sales expectations slipped deeper into negative territory, posting a net balance of -20%, down from -11% in June.

- The 12-month outlook for activity also weakened, falling to -36%, down from -21% in June – the most downbeat reading since March 2020 at the onset of the pandemic.

- On the back of this, 12-month price expectations have eased in each of the last five months, from a net balance reading of +78% in February to +30% now.

Rental market

- Tenant demand remains elevated with a net balance of +36% of contributors noting an increase in July.

- On the supply front, a net balance of -8% of respondents noted a decline in new landlord instructions, identical to last quarter’s reading.

- Rents are expected to rise further over the near-term by a net balance of +57% of respondents.

Back to Retail Economic News