RICS Residential Market Survey July 2021

Buyer enquiries falling

- The RICS UK Residential Survey results for July signal a slightly softer month for new activity across the housing market.

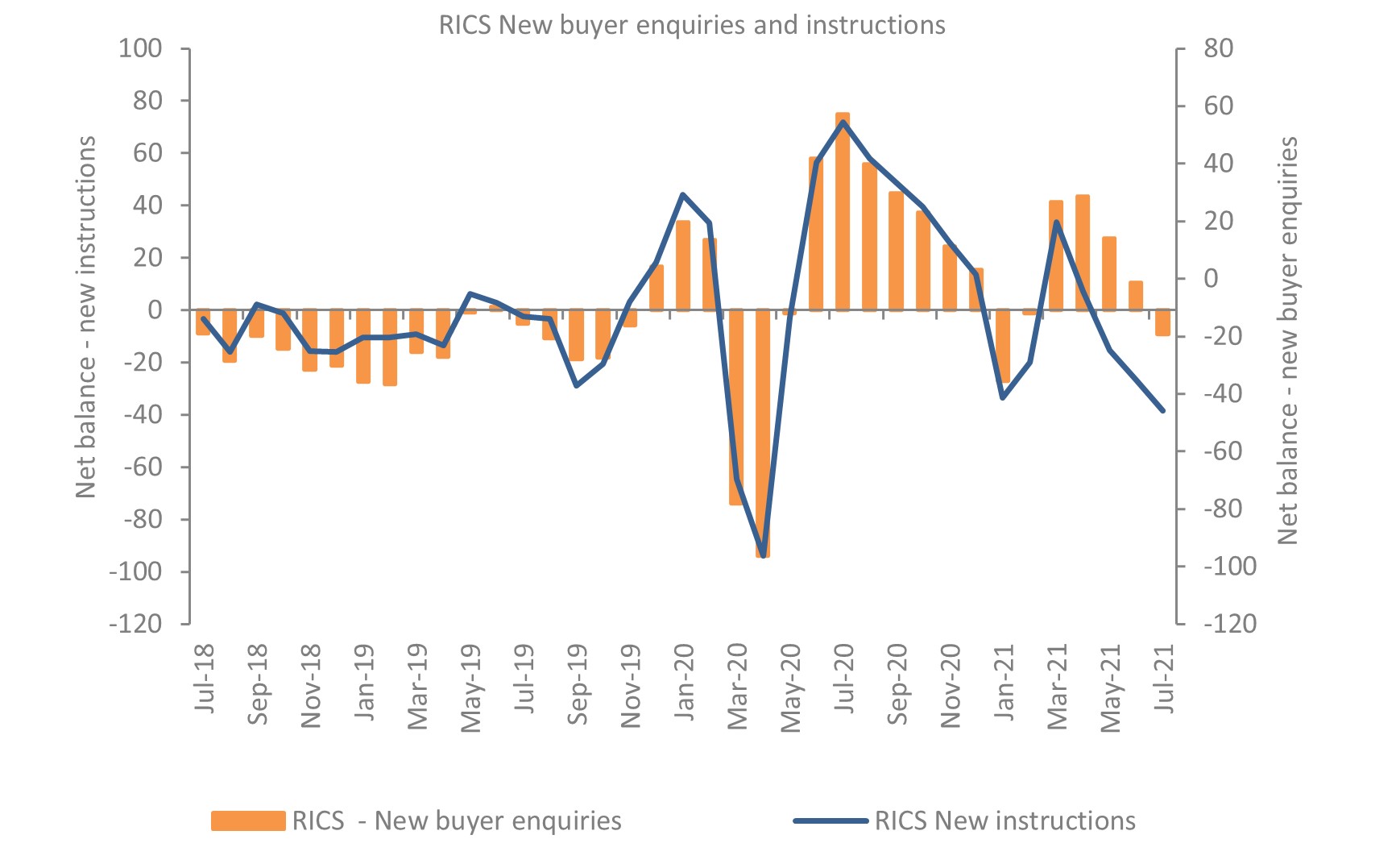

- The measure for new buyer enquiries turned negative, slipping to a net balance of -9% in July (down from +10% previously), ending a run of four consecutive months of increasing demand.

- Newly agreed sales also dropped in July, evidenced by a net balance reading of -21% (compared to -1% in June). Most parts of the UK saw a decline in sales volumes in July, with momentum appearing to slow most notably in Yorkshire & the Humber, the East Midlands and East Anglia.

- On the supply side, there appears to be no let-up in the recent drop off in properties coming to market. The latest net balance for new instructions moved deeper into negative territory at -46% (down from -35% previously). This is the weakest reading for new instructions since April 2020 and marks a fourth consecutive contraction in new listings.

- In terms of the pipeline for new listings going forward, a net share of -21% of survey participants reported that the number of market appraisals being undertaken in July is down on the same period last year (the most subdued reading for this gauge since January 2021 during lockdown).

Tight supply sustains upward price pressures

- At a national level, a net balance of +79% of survey respondents saw a rise in house prices in July, only marginally down on the +82% reading the previous month.

- House price inflation is evident across all UK regions, led by exceptionally strong growth in the North of England and Wales.

- At the other end of the scale, London is seeing more moderate house price growth according to respondents, albeit the latest net balance of +45% is still elevated when placed in a historical context.

- In terms of the outlook for prices, a national net balance of +66% of agents anticipate prices will be higher in twelve months’ time (up from +56% in June).

Stamp Duty holiday phases out

- Near term sales expectations are now broadly flat, with a net balance of just +5% of estate agents expecting sales activity to rise over the next three months.

- Likewise, at the twelve-month time horizon, the net balance figure stands at -2% (slightly improved on -12% last time) which again is indicative of a steady but unimpressive sales picture remaining in place over the year to come.

- Sales expectations are softening now that the Stamp Duty holiday has begun to be tapered out (the threshold halved to £250,000 on 1 July in England and Northern Ireland, while in Wales the tax break on purchases up to £250,000 ends).

London rental market makes a comeback

- In the lettings market, tenant demand continues to pick up, as Covid-19 restrictions are lifted and people return to work (either off furlough or back to the office). A net share of +52% of respondents cited a rise in rental enquiries over the latest three month period.

- London has now reported two consecutive quarterly increases in rental enquiries as the capital’s economy begins to reopen and people gradually return to the office.

- At the same time, landlord instructions remain in decline, with the latest net balance figure coming in at -20% (from -6% previously).

- Rental growth expectations are strengthening on the back of this supply-demand mismatch. A net balance of +50% of respondents envisage headline rents to be higher in a year’s time.

- In London, a net balance of +47% of respondents now foresee rents increasing over the near term, marking a noteworthy turnaround on the net balance of -3% posted in the three months to April (the strongest return for this series across the capital since 2011).

Back to Retail Economic News