RICS Residential Market Survey February 2023

Buyer enquiries rebound but remain in negative territory

- The RICS UK Residential Survey for February results point to continued weakness in market conditions, albeit with the prospect of greater stability as the year progresses.

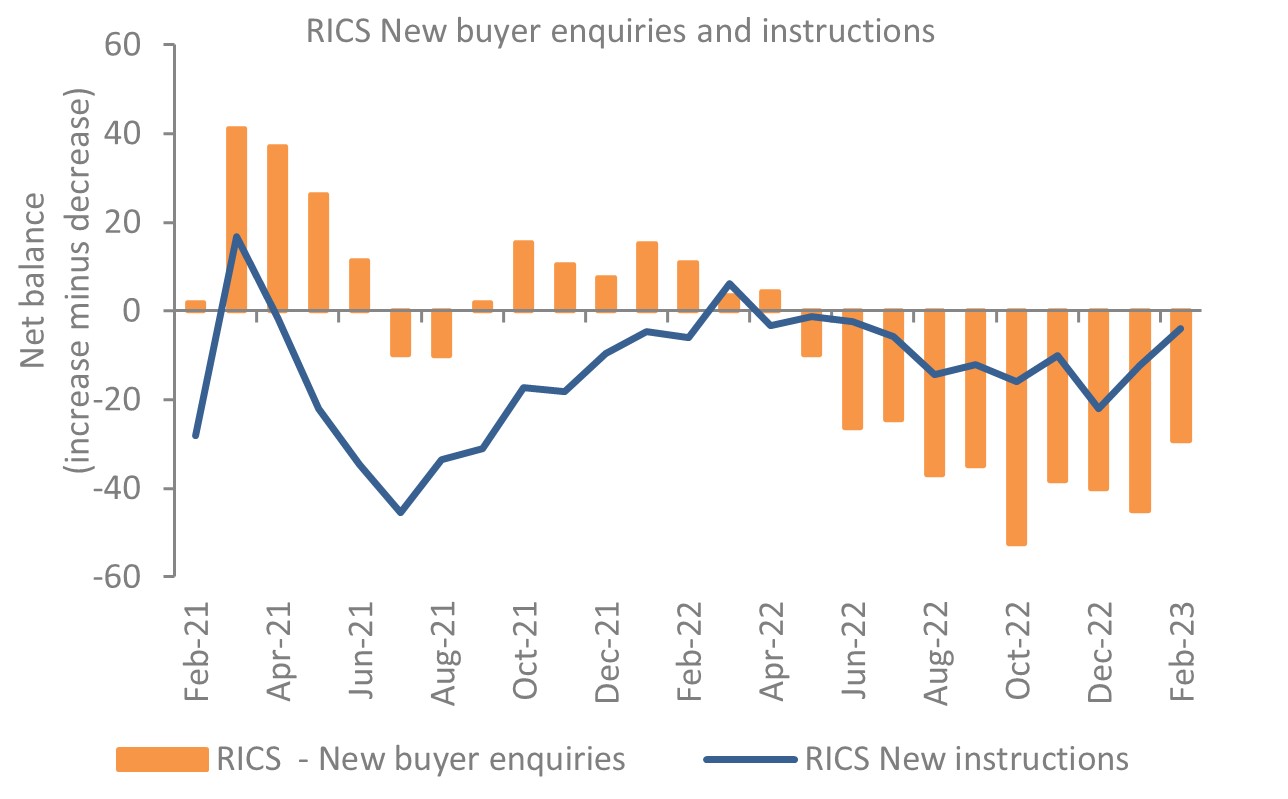

- Buyer enquiries rebounded to a net balance of -29% up from a reading of -45% in January, but remained negative for the tenth consecutive month, albeit being the least negative reading since July 2022.

- In terms of agreed sales, a net balance reading of -26% was posted in February, up from -36% in January. However, the time taken to complete a sale has edged up to 19 weeks.

Inventory levels remain low

- With respect to new instructions, the latest net balance improved to -4%, up from -12% in January and -22% in December.

- According to a net balance of -33% or respondents, the number of market appraisals undertaken over the month was lower than the equivalent period a year ago, up from a reading of -42% in January, but still firmly in negative territory.

- Indeed, the latest inventory level estimate stands at 34.8 properties per surveyor, broadly unchanged from an estimate of 34 in January.

Buyer enquiries in negative territory for the tenth successive month

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Price growth continues to slow

- Prices are softening further as the national net balance for house prices fell marginally to -48% in February, down from -46% in January.

- House prices in Scotland and Northern Ireland continue to show more resilience than those in England and Wales.

Outlook

- Near-term sales expectations remained pessimistic at -47% in February.

- Over the year ahead, a net balance of -8% of respondents foresee sales slipping, compared to a much weaker reading of -20% in January and a low of -45% in August 2022.

- Price expectations for the next three months have risen marginally to a net balance of -55% after a reading of -63% in January.

- Price expectations for the next twelve months remain negative but are somewhat less pessimistic with a net balance of -27%, up from -40% in January.

Rental market

- Tenant demand continues to rise according to a net balance of +32% of contributors.

- On the supply front, a net share of -13% of respondents noted a decline in new landlord instructions.

- As a result, a net balance of +45% of respondents foresee rental prices increasing.

Back to Retail Economic News