RICS Residential Market Survey February 2022

Enquiries up at start of the year

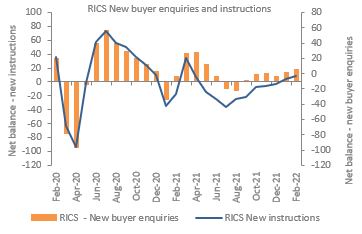

- The RICS UK Residential Survey for February shows buyer enquiries continued to pick up, with a net balance of +17% of agents noting a rise (up from 9% in Dec and 16% in Jan).

- The number of agreed sales also improved over the month, posting a net balance of +9% in February. Although only modestly positive, this is the strongest reading since May 2021.

- The average time to finalise a sale (from initial listing to completion) has gradually fallen over recent months, from an average of 17 weeks in September to 16 weeks in January.

Dearth of instructions

- The protracted deterioration in the number of new properties coming to market has stabilised of late, as the latest net balance moved to -4% from -7% previously.

- Nevertheless, the measure for new instructions remains negative, and has only posted one positive reading in the past twelve months, indicating stock levels remain at historic lows.

- This lack of supply remains the key factor in sustaining sharp rates of house price inflation.

Prices continue to rise

- At a national level, a net balance of +79% of agents noted a rise in house prices in February.

- This is up slightly from an already elevated reading of +74% beforehand and continues to point to a strong increase in house prices across the country.

- All parts of the UK continue to report a further uplift in prices, with Wales, Yorkshire & Humber and the North West seeing especially sharp rates of growth.

Lack of properties on market to meet demand

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Outlook holds firm

- Respondents envisage a further rise in house prices over a three and twelve-month horizon.

- Interestingly, expectations have climbed slightly higher since the first interest rate hike was sanctioned by the Bank of England in December.

- Near term sales expectations also signal continued growth on the horizon, albeit the latest net balance did moderate a little to +11%, compared with +20% seen back in January.

- Likewise, the twelve-month sales expectations series also eased somewhat relative to the previous results but remains consistent with a modestly positive trend in transactions over the year ahead.

Rental market

- Tenant demand is still growing at a solid pace, evidenced by a net balance of +55% of contributors noting an increase in February.

- The supply of rental properties remains challenged, with landlord instructions continuing to dwindle according to a net share of -21% of contributors (down from -13% in Jan).

- This mismatch between supply and demand will drive rents upwards. A net balance of +66% of agents expect headline rents to be higher in three months’ time – the highest figure on record.

- Over the next twelve months, survey contributors foresee UK rental prices rising by 4.5% on average.

Back to Retail Economic News