RICS Residential Market Survey August 2022

Sharp decline in buyer enquiries

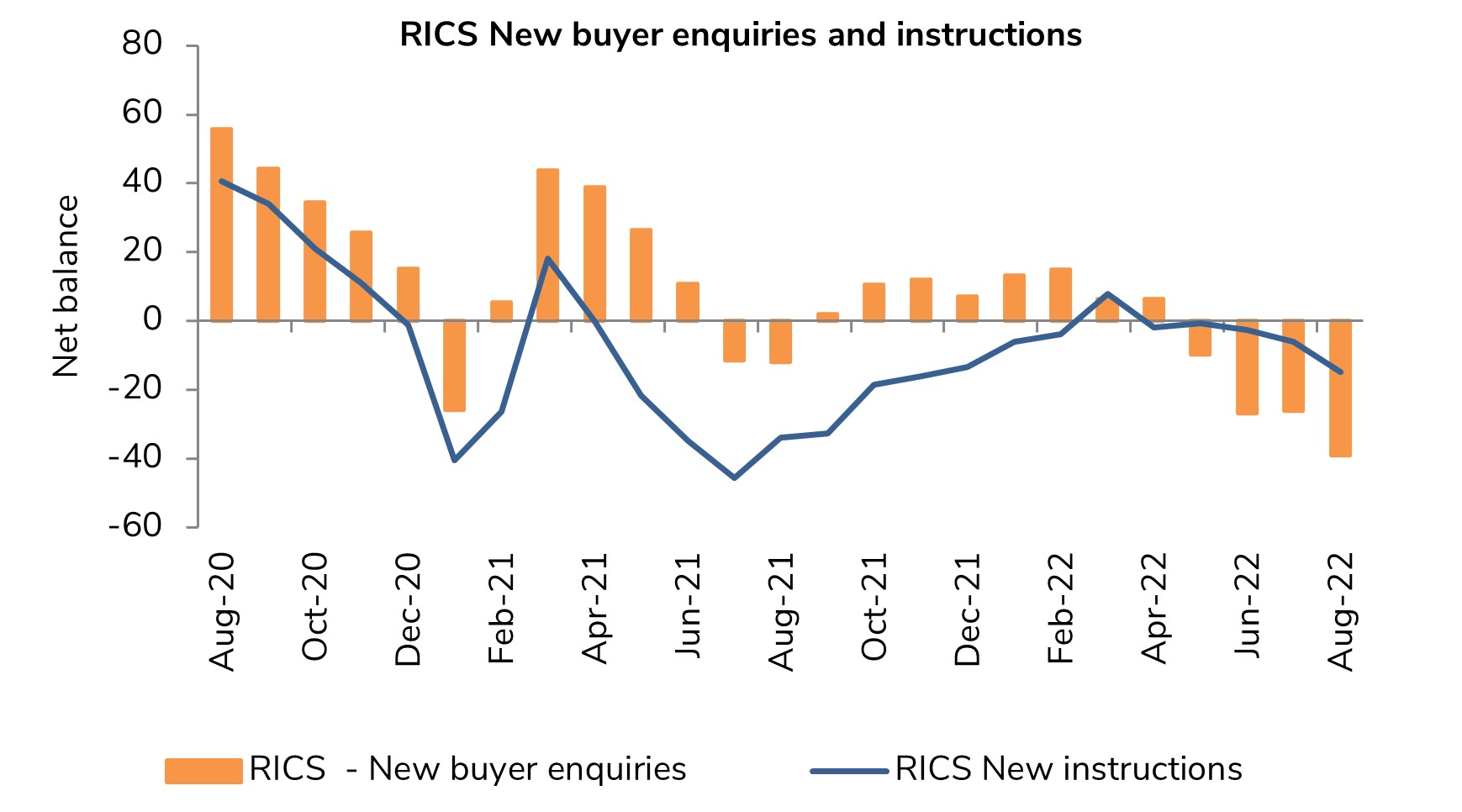

- The RICS UK Residential Survey for August point to the recent downward trend in market activity becoming further entrenched, with enquiries, sales and new instructions all falling at a faster pace than last month.

- The net balance for new buyer enquiries registered -39%, down from -26% in July, and the weakest reading since April 2020.

- Most regions/countries of the UK are seeing buyer demand fall back to some extent. That said, enquiries were more resilient in London over the month, holding broadly steady.

- In terms of agreed sales, a net balance reading of -22% was posted in August, representing a further softening from a figure of -13% seen previously.

- Agreed sales have now fallen for five consecutive months, with the latest feedback implying this downward trend is gathering pace.

Inventory levels at record low

- With respect to new instructions, the latest net balance of -15% points to a notable decline in the flow of fresh listings coming onto the sales market.

- As a result, average inventory levels on estate agent’s books sunk to a fresh all-time low of just 34 homes in August.

- Looking ahead, contributors continue to note that the current level of market appraisals being undertaken is similar to that seen twelve months ago, suggesting the tight supply backdrop is unlikely to change dramatically in the near future.

Residential market indicators weakening

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Prices still rising

- At a national level, a net balance of +53% of agents noted a rise in house prices in August.

- Price growth (in net balance terms) has now moderated to some degree in four successive months, following a recent high of +78% recorded in April this year.

- Nevertheless, the latest feedback remains consistent with a still reasonably solid degree of upward movement in house prices for the time being.

- Respondents across Northern Ireland, the North West, London and East Anglia in particular continue to highlight relatively firm house price growth at this stage.

Outlook

- Near term sales expectations remain stuck in negative territory, at -26% in August.

- Over the next twelve months, a national net balance of -45% of respondents foresee sales slipping, marking the poorest return for this series since its formation in 2012

- Price expectations for the next twelve months returned a net balance of just +3% in August, down from a reading of +30% last time.

- This indicates a flat projection for national house prices over the twelve-month time horizon.

- Indeed, respondents estimate house prices will rise by just a 0.2% over the year to come.

Rental market

- Tenant demand remains elevated with a net balance of +50% of contributors noting an increase in August (up from +43% in July).

- On the supply front, a net share of -13% of respondents noted a decline in new landlord instructions, with falling supply across the rental market an ongoing theme.

- Given the excess of demand over supply, rents are expected to rise by a net balance of +49% of survey participants in the near-term.

- When viewed over the next twelve months, rents are anticipated to rise by close to 4% at the national level.

Back to Retail Economic News