RICS Residential Market Survey August 2021

New listings continue to fall

- The RICS UK Residential Survey results for August show another softer month for new activity across the housing market.

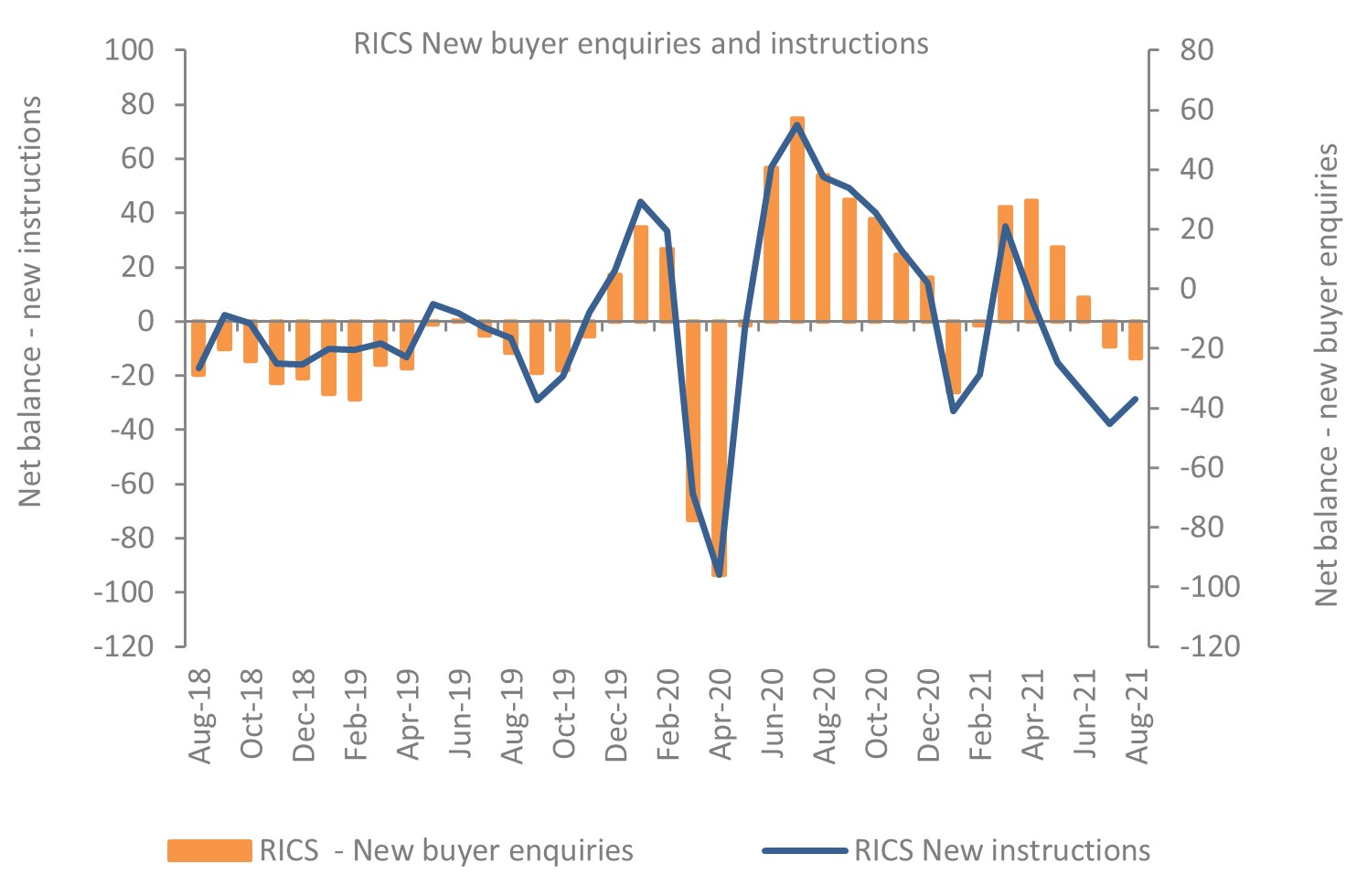

- The measure for new buyer enquiries fell for a second consecutive month, slipping deeper into negative territory with a net balance reading of -14% in August (down from -9% in July).

- Agreed sales also dropped in August for the second month in a row, evidenced by a net balance reading of -18% (compared to -22% in July).

- On the supply side, the measure for the number of new properties coming to market has fallen for eight of the past nine months. The latest net balance for new instructions came in at -37% (marginally less negative than the -45% recorded in July).

- Stock levels on estate agents books have dropped from an average of 42 homes per branch at the start of the year, to stand at 38 in August

- In terms of the pipeline for new listings going forward, feedback from agents points to market appraisals currently running at a slightly slower pace than the same period last year (net balance of -10% in August, compared to -21% in July)

House prices rising at a slower pace

- The lack of available stock on the sales market is frequently mentioned by respondents to be a key factor sustaining strong rates of house price inflation.

- At a national level, a net balance of +73% of survey respondents noted a rise in house prices in August.

- While this has moderated from a recent high of +81% seen back in May/June, the latest reading remains elevated when placed in a historical context.

- In terms of the outlook for prices, a net share of +23% of respondents anticipate prices will continue to climb over the next three months (marginally down on +28% in July).

- On a twelve-month horizon, a national net balance of +66% of agents anticipate prices will be higher in a year’s time (identical to July’s reading and firmly in expansionary territory).

Sales expectations flat

- Near term sales expectations remain broadly flat, with a net balance of just +4% of estate agents expecting sales activity to rise over the next three months (unchanged from July).

- Looking further ahead, respondents now envisage transaction levels to edge slightly higher over the next twelve months, with the net balance for long-term sales expectations reaching +7% in August (up from -2% previously)

- Sales expectations for the year ahead are most positive across London, Northern Ireland and the South East of England.

Rents projected to rise by over 3% per year

- In the lettings market, tenant demand appears to be accelerating, as people continue to return to their workplace (either off furlough or back to the office). A net share of +66% of respondents reported a rise in rental enquiries in August (up from +58% previously).

- At the same time, landlord instructions remain in decline, with this indicator stuck in negative territory for most of the last year.

- Due to this supply-demand imbalance, rental growth expectations are strengthening. A net balance of +64% of agents anticipate headline rents to be higher in three month’s time – the strongest reading for this indicator since its formation in 2013.

- For the coming twelve months, national rental growth projections moved above 3% for the first time since 2016. When broken down, all regions/countries of the UK are now expected to see rents rise by more than 2.5% on an annual basis.

- Over the next five years, rents are projected to increase by 4% per annum across the UK as a whole, while house price growth is expected run slightly ahead of this rate, at closer to 5%.

Housing market activity continues to cool in August

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Back to Retail Economic News