RICS Residential Market Survey April 2022

Buyer demand steady

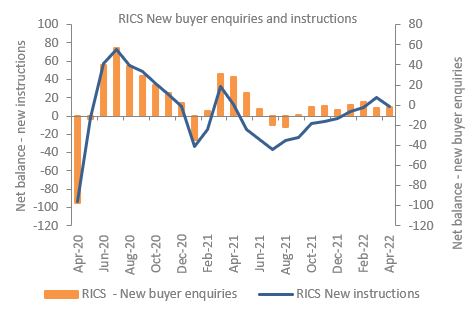

- The RICS UK Residential Survey for April shows a net balance of +10% of agents noted a rise in new buyer enquiries, similar to the rise last month.

- Agreed sales fell in April to a net balance of -9% following two consecutive months of growth.

New instructions fall back

- The net balance for new instructions fell back into negative territory in April (-1%) having risen last month for the first time in a year.

- Resultantly, average stock levels on estate agents’ book remained low compared to historical standards.

- The number of appraisals being undertaken over the month was said to be little changed compared to a year ago following rises in recent months.

Prices continue to rise

- At a national level, a net balance of +80% of agents noted a rise in house prices in April, up from 74% last month.

- All parts of the UK continue to report an uplift in prices, with notable rises seen in Northern Ireland and Wales.

Buyer demand continues to outstrip housing supply

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Looking ahead

- Respondents expect house prices to rise further over a three and twelve-month horizon, posting net balances of +24% and +62% respectively, easing on the previous month.

- Near term sales expectations remain positive, with the latest net balance coming in at +12% (from +16% previously).

- Further ahead, twelve-month expectations slowed for the fourth consecutive month recording a negative net balance of -4% in April. A flat trend for residential sales volumes at the national level is expected to continue.

Rental market

- Tenant demand continues to rise with a net balance of +52% of contributors noting an increase in April.

- Landlord instructions remained in negative territory at -7% although this is above the average reading seen over the last year (-17%).

- A net balance of +63% of agents expects headline rents to be higher in three months’ time – a new record high.

Back to Retail Economic News