Retail Economics Response – Consumer Prices Index: July 2019

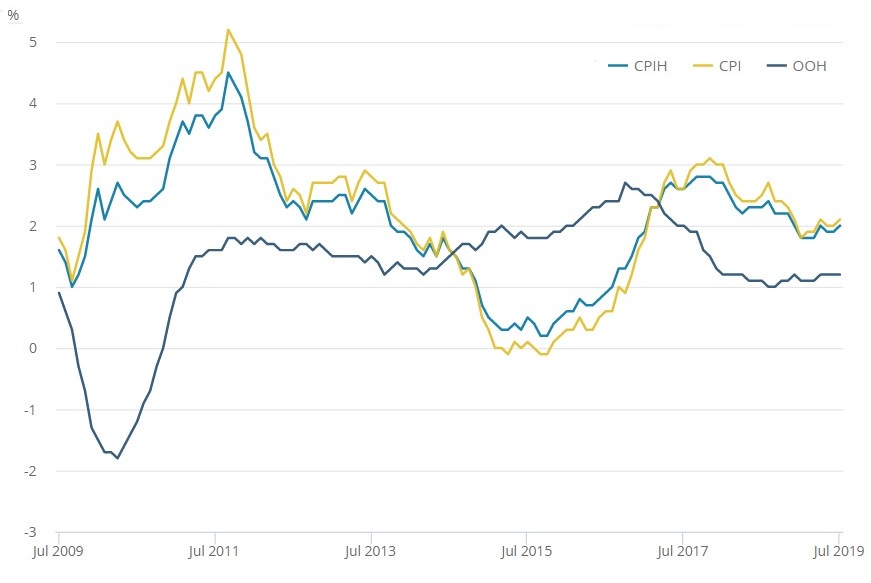

The headline Consumer Price Index (CPI) rose 2.1% in July, year-on-year, up from the 2.0% rise in the previous month and above expectations.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) 12-month inflation also rose, up 2.0%, year-on-year.

Meanwhile, both the Retail Price Index (RPI) and RPI (excluding mortgage payments, RPIX) slowed, falling to 2.8% and 2.7% respectively.

Pressure in the supply chain picked up in July, with input price inflation rising to 1.3% following an upwards revision to the annual rate in June which meant inflation was now a positive 0.3% (from the

-0.3% reported last month). Output inflation also rose, up 1.8% year-on-year, from the 1.6% rise in the previous month.

The largest upward contribution to the change in the 12-month CPI rate came from recreation and culture. This was predominantly driven by the games, toys and hobbies component where prices rose 8.4% between June and July 2019 compared with a smaller rise (4.1%) between the same two months a year earlier. This is a reversal of last month’s trend which saw the component make a downward contribution.

Restaurants and hotels also made a upward contribution, with prices for accommodation services rising by a greater amount between June and July this year, compared with a year earlier.

Elsewhere, clothing and footwear (notably from footwear including repairs and garments) and miscellaneous goods and services also made large upward contributions.

Within the Transport category, transport services made a large downward contribution which somewhat offset the above upward pressures. Indeed, prices rose 2.6% between June and July this year compared with a 6.1% rise between the same two months a year earlier. Also within the broader Transport category, the operation of personal transport equipment exerted downward pressure.

The final notable downward contribution came from housing and household services, with prices of electricity, gas and other fuels being little changed this year compared with a rise a year earlier.

Core inflation (which excludes food and energy prices) rose for the second consecutive month, albeit marginally to 1.9%, year-on-year, from the 1.8% rise in June 2019.

Despite the unexpected uptick in inflation, yesterday’s sharp rise in average earnings growth of 3.9% means that real earnings are rising at c.1.8%.

Figure 1: CPIH, OOH (owner occupiers’ housing costs) and CPI 12-month inflation rate for the last 10 years: July 2009 to July 2019.

Source: ONS

Back to Retail Economic News