ONS Retail Sales May 2021

Retail sales (value, non-seasonally adjusted, excluding fuel) soared 22.3% year-on-year in May against an 8.7% decline during the first lockdown a year earlier according to the latest ONS data.

In volume terms, retail sales increased by a strong 21.7% in May on the previous year (seasonally adjusted, excluding fuel), but dipped 2.1% compared to April as food sales came under pressure.

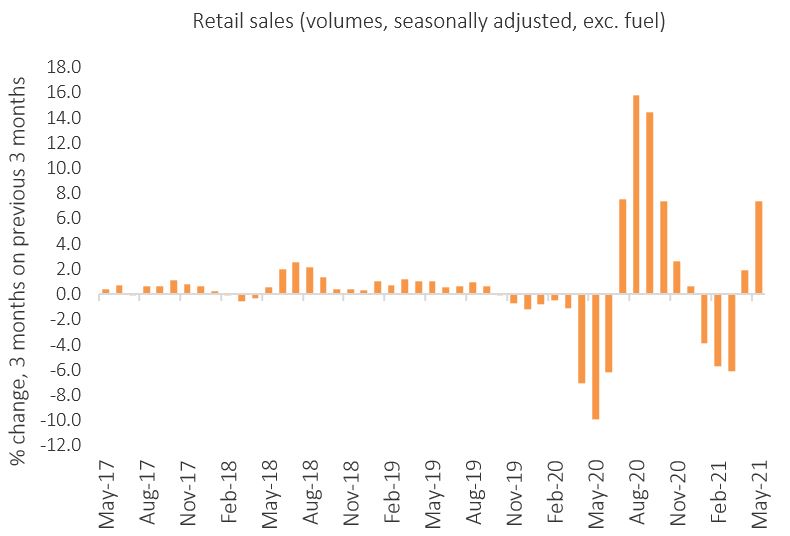

Retail sales (volume, seasonally adjusted) – 3-months on previous 3-months

Source: ONS

Food has experienced heightened sales since the pandemic, benefiting from a transference of spend away from hospitality during lockdowns and increased homeworking over the past year.

But pent-up demand saw consumers take advantage of dining out as Covid restrictions eased for the hospitality sector in May. This saw the ONS report that the largest contribution to the month-on-month decline in retail sales in May came from food stores, where volumes fell by 5.7%.

By contrast, non-food stores saw a 2.3% increase in monthly sales volumes in May. Household goods reported the largest growth of 9.0% as consumers continue to invest in improving home life.

The ONS noted that all categories except food reported a month-on-month softening of online sales. Online sales (non-seasonally adjusted, excluding automotive fuel) increased by just 1.8% year-on-year in May against a 59.6% rise a year earlier.

The proportion of retail sales made online continued to decline to 27.3% in May, from 29.4% in April. This is below the 32.3% online accounted for in May 2020 when non-essential stores were closed.

The retail sales deflator (a measure of inflation specific to retail) excluding fuel increased by 1.2% compared to last year, and rose 2.2% when including fuel.

The implied price deflator among food stores dipped by 0.1% year-on-year, but rose among non-food stores at the fastest rate in more than three years at 2.5% in May.

Back to Retail Economic News