ONS Retail Sales December 2020

Retail sales (value, non-seasonally adjusted, excluding fuel) dipped by 0.3% year-on-year in December according to the latest ONS data, against a backdrop of shop closures in some regions during the run up to Christmas.

December 2020 came against a robust comparative – with sales rising by 3.2% in the previous year – as Black Friday fell into the December reporting period in 2019 unlike in 2020.

In volume terms, retail sales rose by 6.4% in December 2020 on the previous year (seasonally adjusted, excluding fuel). On a month-on-month basis, volumes edged up by 0.4% compared to November’s lockdown.

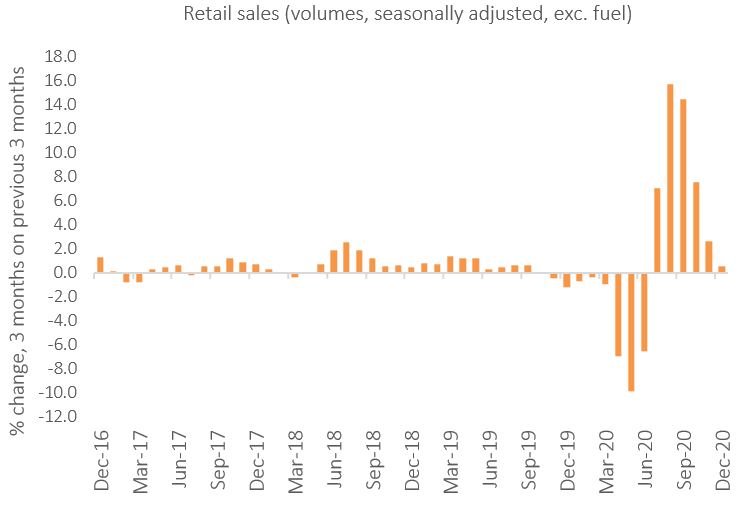

Retail sales (volume, seasonally adjusted) – 3-months on previous 3-months

Source: ONS

The ONS noted that 2020 marked the worst year since records began in 1997, with the volume of retail sales falling by 1.9% across the year as a whole.

Clothes shops have been the hardest hit by social restrictions, with declines of 25.1% across 2020 when compared with 2019. But in December, clothing retailers saw the largest monthly growth of 21.5% as restrictions initially eased early in the month, rebounding from the monthly fall of 19.6% reported in November.

Christmas shopping online and through click and collect delivery has helped reduce the impact of recent Covid-19 restrictions on retail.

Store closures as some regions entered Tier 4 restrictions ahead of Christmas and the New Year saw online sales (non-seasonally adjusted, excluding automotive fuel) surge by 45.8% year-on-year in December.

This saw online account for 31.3% of total retail sales in December – a significant step up from 21.4% a year earlier. However, this is down on the record 36.2% seen during the four-week national lockdown in November.

The retail sales deflator (a measure of inflation specific to retail) excluding fuel edged down by 0.6% compared to last year (and dipped 1.0% when including fuel).

The implied price deflator among non-food stores declined by 0.4% in December, while prices among food stores dropped 0.6% year-on-year.

Back to Retail Economic News