ONS Labour Market September 2021

Vacancies hit another record

- Ongoing recruitment challenges as the economy opens up again has seen the estimated number of vacancies hit another record high.

- Between June and August, the number of vacancies tipped one million for the first time at 1,034,000 – some 249,000 above its pre-pandemic January to March 2020 level – supported by a 75.4% increase in the quarter among accommodation and food service activities.

Payroll recovers

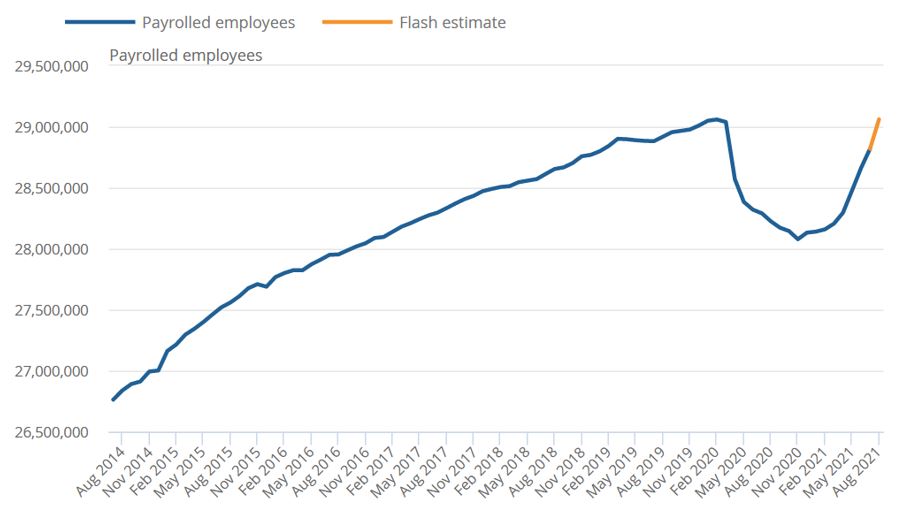

- Early payroll estimates for August show the number of payrolled employees rose by 3.0% year-on-year – or 836,000 employees – edging up by 1,000 employees on February 2020.

- All age groups saw an increase in payrolled employees between August 2020 and August 2021.

- Workers aged 16 to 24 years old have been particularly affected by the pandemic, but there has been a strong increase in the employment with an increase of 381,000 payrolled employees aged under 25 years in August.

- The rate of recovery in payroll employees differs by industry. Three of the sectors that have had the greatest decreases since Covid have seen robust monthly increases of late in payrolled employees. Between July and August, accommodation and food service activities increased by 36,000 employees, arts and entertainment by 11,000, and wholesale and retail by 7,000.

Payrolled employees, seasonally adjusted, UK, July 2014 to August 2021

Source: HM Revenue and Customs – Pay As You Earn Real Time Information

- On the wider survey measure of employment, the employment rate was still down 1.3 percentage points on pre-pandemic levels at 75.2% in the quarter to July. However, this marked a 0.5 percentage point uplift on the previous quarter (February to April 2021).

- The number of part-time workers decreased significantly during the pandemic, but has been increasing since April to June 2021, making up the majority of the most recent increase in employment.

- It should be noted that more than a million people remain furloughed ahead of the scheme’s closure at the end of this month who are classed as employed.

Unemployment dips

- The latest unemployment estimates show a 0.3 percentage point dip on the previous quarter to 4.6% in the three months to July. This is 0.6 percentage points higher than before the pandemic.

- The quarterly decrease in unemployment continued to be driven by those unemployed for less than 12 months. By comparison, those in long-term unemployment over a year continued to increase, up by 80.9% year-on-year to 445,000 people in the three months to July.

Hours worked improving

- In the three months to July, total actual weekly hours worked stepped up by 43.2 million hours from the previous quarter to 1.01 billion hours as Covid restrictions eased.

- However, this is still 4.3% below pre-pandemic levels, or 45.4 million hours.

Earnings climb

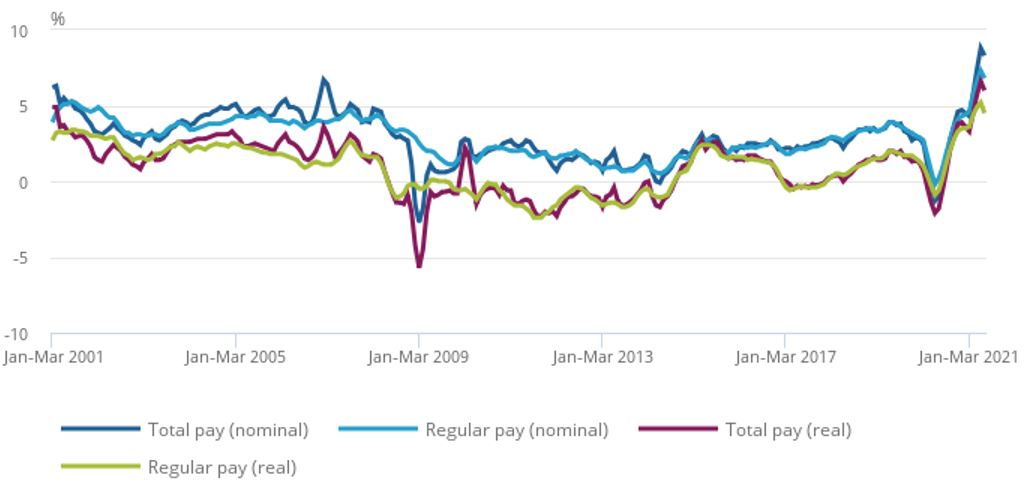

Annual pay continued to increase in the three months to July. In nominal terms:

- Average regular pay (excluding bonuses) for employees in Great Britain was £542 per week before tax and other deductions from pay – up from £512 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £578 per week before tax and other deductions from pay – up from £539 per week a year earlier.

- Regular and total pay growth rose by 6.8% and 8.3% respectively in the three months to July compared to a year earlier.

- In real terms (adjusted for inflation), total and regular pay are growing at 6.0% for total pay and 4.5% for regular pay.

It should be noted that:

- Annual growth in average employee pay continued to be disrupted by compositional effects from a fall in the number and proportion of lower-paid jobs.

- Additionally, pay growth is being affected by a base effect from weak annual comparisons.

Great Britain, average weekly earnings annual growth rates, January to March 2001 to May to July 2021

Source: ONS

Back to Retail Economic News