ONS Labour Market November 2023

Vacancies continue to fall

- The number of job vacancies in August to October 2023 was 957,000 – a decrease of 58,000 from the previous quarter, marking the 16th consecutive decrease and the lowest figure since April to June 2021.

- Vacancies declined in 16 of 18 sectors measured on a quarterly basis. The largest fall in vacancies came from professional, scientific, and technical activities, which was down by 9,000.

- On an annual basis, total vacancies decreased by 257,000. 15 of 18 sectors faced decline, with professional, scientific, and technical activities experiencing the largest fall.

- The total number of vacancies remains 156,000 above pre-pandemic levels (January to March 2020).

Payrolled employees increase

- Early payroll estimates for October show the number of payrolled employees rose by 398,000 employees compared to the previous year (up 1.3%).

- Compared to the previous month, the number of payrolled employees increased by 33,000 employees (0.1%).

- The largest yearly increase in payrolled employees continued to be driven by health and social work sector (a rise of 221,000 employees YoY).

Unemployment rate flat

- Experimental estimates for July to September 2023 show the UK unemployment rate was unchanged on the previous quarter at 4.2%.

Employment rate declines

- Experimental estimates for July to September 2023 show a 0.1pp quarterly decrease in the UK employment rate to 75.7% compared with the previous quarter.

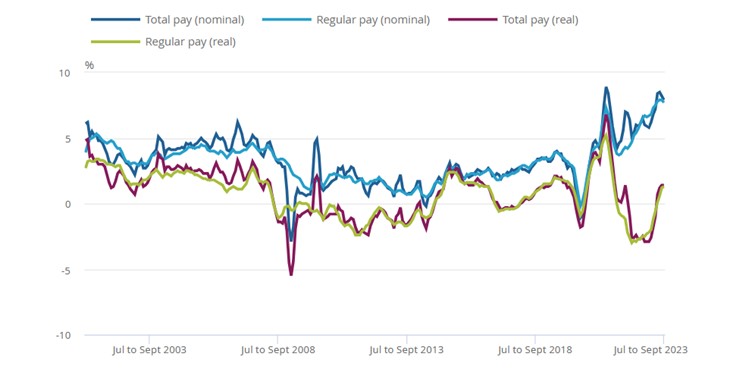

Earnings outstrip price rises

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £621 per week before tax and other deductions from pay in September.

- Average total pay (including bonuses) for employees in Great Britain was £673 per week before tax and other deductions from pay in September.

- Regular pay rose by 7.7% and total pay by 7.9% in the three months to September compared to a year earlier.

- Average regular pay growth in the private sector was 7.8% in the three months to September, while public sector pay rose by 7.3%.

- In real terms (adjusted for CPIH inflation), regular pay and total pay increased 1.3% and 1.4% YoY respectively in the three months to September.

Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to July to September 2023

Source: ONS

Back to Retail Economic News