ONS Labour Market May 2023

Tenth consecutive quarterly fall in vacancies

- The number of job vacancies in February to April 2023 was 1,083,000 – a decrease of 55,000 from November 2022 to January 2023.

- The largest falls in vacancies came from financial and insurance activities, and mining and quarrying which both decreased by 15.7% and 11.1% respectively. Wholesale and retail trade; repair of motor vehicles and motorcycles further saw vacancies fall by 8.2%.

- Administrative and support service activities and other service activities saw the largest quarterly growth in vacancies, with increases of 6,000 and 3,000 respectively.

- On an annual basis, total vacancies decreased by 214,000, with accommodation and food service activities and information and communication experiencing the largest falls, falling by 37,000 and 30,000 respectively.

- The total number of vacancies remained 282,000 above pre-pandemic levels (January to March 2020).

Continued fall in retail employees

- Early payroll estimates for April show the number of payrolled employees rose by 297,000 employees compared to the previous year (up 1.0%).

- On the previous month, the number of payrolled employees fell by 136,000, or 0.5%.

- The largest yearly increase in payrolled employees continued to be driven by health and social work sector (a rise of 154,000 employees YoY), while the smallest was in the wholesale and retail sector (a fall of 62,000).

Record net flow out of inactivity

- The unemployment rate for January to March 2023 is estimated at 3.9%, 0.1pp higher than the previous three-month period and 0.1pp below pre-pandemic levels.

- In the quarter, the number of people unemployed for up to 6 months and for over 12 months increased, compared with the previous three-month period.

- The number of people unemployed from six to twelve months decreased in the period.

- The economic inactivity rate decreased by 0.4pp on the quarter to 21.0% in January to March, driven by students and those previously looking after family or the home coming into work. The period saw a record high net flow out of economic inactivity, with 63% of the inflows to employment coming from economic inactivity.

- Although declining, inactivity is 0.8pp above the pre-pandemic level, as those inactive because of long-term sickness increased to a record high.

Employment rate edges up

- The employment rate for January to March rose 0.2pp in the quarter to 75.9% but is 0.7pp below pre-pandemic levels.

- The number of full-time employees decreased in the period but remains above pre-pandemic levels, while the number of part-time employees and self-employed workers increased in the three-month period.

Hours worked increases

- Total actual weekly hours worked increased by 16.3 million hours on the quarter to 1.05 billion hours in January to March.

- This is 0.2 million hours below pre-pandemic levels (December 2019 to February 2020).

- The increase in January to March was largely among men, whose actual weekly hours worked remain below pre-pandemic levels. Total actual weekly hours worked by women also increased and are above pre-pandemic levels.

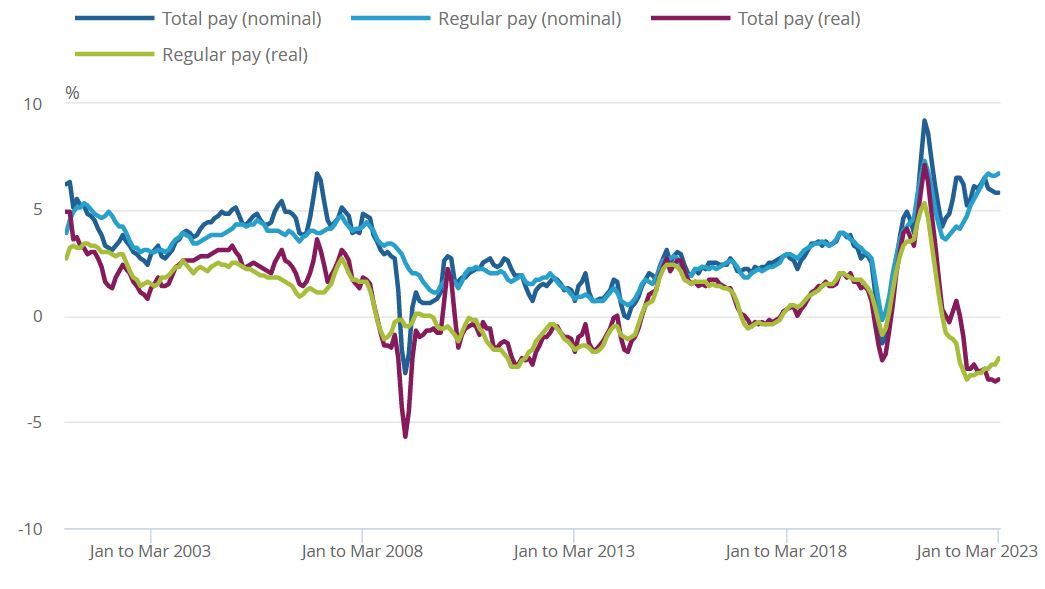

Real earnings decline

Both annual total and regular pay growth continued to lag inflation in the three months to March.

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £598 per week before tax and other deductions from pay in March – up from £559 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £642 per week before tax and other deductions from pay in March – up from £612 per week a year earlier.

- Regular pay rose by 6.7% and total pay by 5.8% in the three months to March compared to a year earlier. This remains the highest growth for regular pay seen outside the pandemic.

- Average regular pay growth in the private sector was 7.0% in the three months to March, while public sector pay rose by 5.6%.

- The difference between private and public sector growth rates has narrowed, with larger growth in public sector pay outside the pandemic last being seen in August to October 2003 (5.7%).

- In real terms (adjusted for inflation), regular pay and total pay declined 2.0% and 3.0% YoY respectively in the three months to March.

Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to January to March 2023

Source: ONS

Back to Retail Economic News