ONS Labour Market May 2021

Job vacancies in the UK have hit their highest level since the start of the pandemic, with an increase in the quarterly employment rate and a decrease in the quarterly unemployment rate suggesting “some early signs of recovery” according to the ONS.

Hiring up as lockdown eases

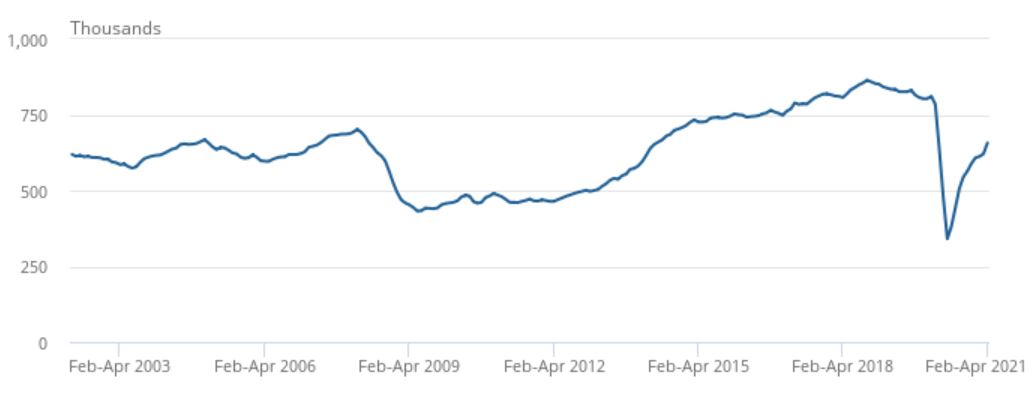

- Between February and April, the number of vacancies reached its highest level since January to March 2020, with most industries showing increases – but particularly accommodation and food service activities.

- In the quarter to April, there were 657,000 vacancies, up by some 48,400 – or 8.0% – on the previous quarter as restrictions unwind. But despite the rise in job vacancies over the past year, vacancies are some 128,000 below the pre-pandemic level in the January to March quarter of 2020.

- Single-month estimates show an increase in vacancies in early April, reaching near pre-pandemic levels according to statistics of online job adverts from Adzuna.

Number of vacancies in the UK, seasonally adjusted,February 2002 to April 2002 to February 2021 to April 2021

Source: ONS

Payroll rises

- Early payroll estimates for the quarter to April show the number of payroll employees increased for a fifth consecutive month, but remains some 772,000 below pre-pandemic levels – with the largest falls among hospitality, those aged under 25 years, and those living in London.

- The UK employment rate was estimated at 75.2% in the three months to March, which is 0.2 percentage points higher than the previous quarter. This was driven by an increase in the number of full-time employees. However, it is 1.4 percentage points lower than before the pandemic (December 2019 to February 2020).

- It should be noted that there are still over four million workers on the furlough scheme, who count as employed.

- Younger workers been particularly impacted by the pandemic. The quarter to March has seen a decrease in the employment and unemployment rates for young people –particularly amongst 16- to 17-year-olds – and record economic inactivity among young people in full-time education, suggesting that more young people are staying in education and not looking for work.

Unemployment dips

- The latest unemployment estimates show the largest quarterly decrease since September to November 2015, falling 0.3 percentage points on the previous quarter to 4.8% in the three months to March.

Hours worked impacted by restrictions

- With the reintroduction of tougher coronavirus restrictions between January and March, total hours worked decreased on the quarter.

- Between January and March, total actual weekly hours worked was 956.2 million hours in the UK. This marked a decrease of 11.8 million hours from the previous quarter.

Earnings rise

Annual growth in average employee pay continued – driven in part by compositional effects from a fall in the number and proportion of lower-paid jobs.

For March in nominal terms:

- Average regular pay (excluding bonuses) for employees in Great Britain was £535 per week before tax and other deductions from pay – up from £510 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £562 per week before tax and other deductions from pay – up from £540 per week a year earlier.

- Total and regular pay growth is outpacing inflation, at 4.1% and 4.9% in March compared to a year earlier.

- The ONS estimates that adjusting for inflation and removing the compositional effect of fewer lower-paid jobs, the underlying wage growth is around 1.5% for total pay and 2.0% for regular pay.

Great Britain, AWE annual growth rates, January to March 2021

Source: ONS

Back to Retail Economic News