ONS Labour Market March 2022

Further rise in vacancies

- Job vacancies hit a new record high of 1,318,000 between December 2021 to February 2022. This marked an increase of 105,000 from the previous quarter.

- However, the rate of quarterly growth slowed for the seventh consecutive period to 8.7% and down from 17.2% in the previous quarter.

- By industry, the largest increase on the quarter came from wholesale and retail trade (16,800).

Uplift in hospitality payroll

- On the wider survey measure of employment covering the quarter to January, the employment rate was 1.0 percentage points down on pre-pandemic levels at 75.6%.

- However, this marked a 0.1 percentage point uplift on the previous quarter to October.

- The redundancy rate decreased to a record low of 2.4 per thousand employees.

Unemployment falls to 3.9%

- The latest unemployment estimates show a 0.2 percentage point drop on the previous quarter to 3.9% in the three months to January, returning to pre-pandemic levels

- The quarterly decrease in unemployment was driven by a decrease in the unemployment rate for young people to below pre-coronavirus pandemic rates.

- The economic inactivity rate increased by 0.1 percentage points to 21.3%. Over the three-month period, above pre-Covid levels.

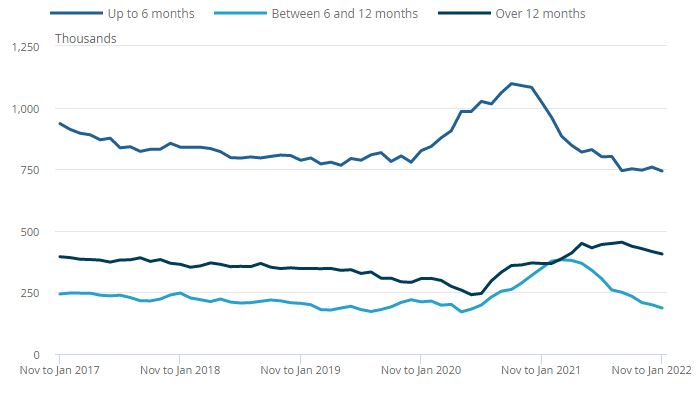

The decrease in unemployment over the latest three-month period was driven by those unemployed for over six months. UK unemployment by duration, SA, between November 2016 to January 2017 and November 2021 to January 2022

Source: Office for National Statistics

Rise in hours worked

- In the three months to January, total actual weekly hours worked increased by 4.7 million hours compared with the previous three-month period to 1.03 billion hours.

- This is 23.1 million hours below pre-coronavirus levels (December 2019 to February 2020).

Pay squeeze weakens

Annual pay growth edged higher in the three months to January but remains below inflation.

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £555 per week before tax and other deductions from pay – up from £533 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £596 per week before tax and other deductions from pay – up from £568 per week a year earlier.

- Regular and total pay growth rose by 3.8% and 4.8% respectively in the three months to January compared to a year earlier.

- In real terms (adjusted for inflation), total pay rose just 0.1% in the three months to January, while regular pay declined 1.0% in the period.

Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to November 2021 to January 2022

Source: ONS

Back to Retail Economic News