ONS Labour Market March 2021

The latest ONS data suggests unemployment edged down despite the economy facing lockdown restrictions, but the rate of increase in job openings has slowed strongly in recent months.

Vacancies slow

- In December 2020 to February 2021, there were an estimated 601,000 job vacancies. The number of vacancies in the quarter was 26.8% lower than the estimated 821,000 vacancies a year earlier.

- While this is an improvement on summer 2020 when vacancies were down by nearly 60% year on year, the rate of improvement has slowed in recent months.

- Further restrictions and national lockdowns have disproportionately impacted vacancies in some sectors more than others – notably the accommodation and food services industry.

Monthly unemployment edges down

- The single-month and weekly estimates of the unemployment rate suggest that the rate decreased slightly in January 2021.

- However, the unemployment rate at 5.0% in the three months to January is 1.1 percentage points higher than a year earlier.

- The number of people unemployed was estimated at 1.70 million, up 360,000 on the same period a year ago and up 11,000 on the quarter.

Employment drops across food and retail

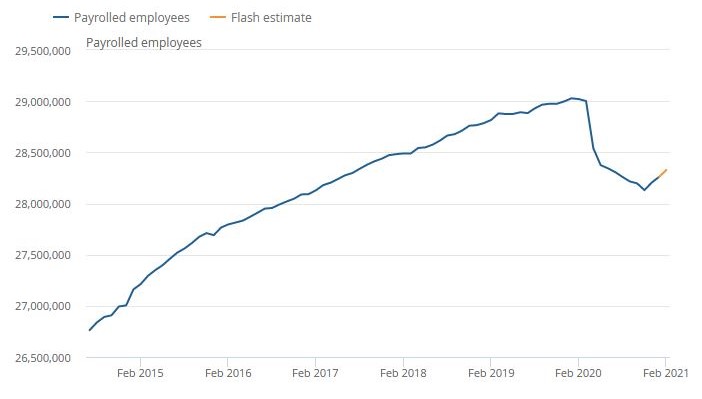

- Early estimates for February show the number of payroll employees edged up by 0.2% compared with January. But importantly, this marks a fall of 2.4% compared with last year year and a decline of 693,000 people over the 12-month period.

- Of the 693,000 people, 368,000 can be attributed to employees working in the accommodation and food service activities sector and 123,000 in the wholesale and retail trade sector.

Payrolled employees, seasonally adjusted, UK, July 2014 to February 2021

Source: HMRC

- The UK employment rate came in at 75.0% in the three months to January 2021 – 0.3 percentage points down on the quarter and 1.5 percentage points lower than a year earlier.

- This equates to 32.37 million people aged 16 years and over in employment, which is 611,000 fewer than a year earlier.

Recovery in hours worked impacted

- The recent recovery in hours worked has shown signs of slowing, impacted by recent coronavirus restrictions.

- Between November 2020 and January 2021, total weekly hours worked rose by 8.0 million, or just 0.8%, to 968.0 million hours, compared to the previous quarter.

Earnings up

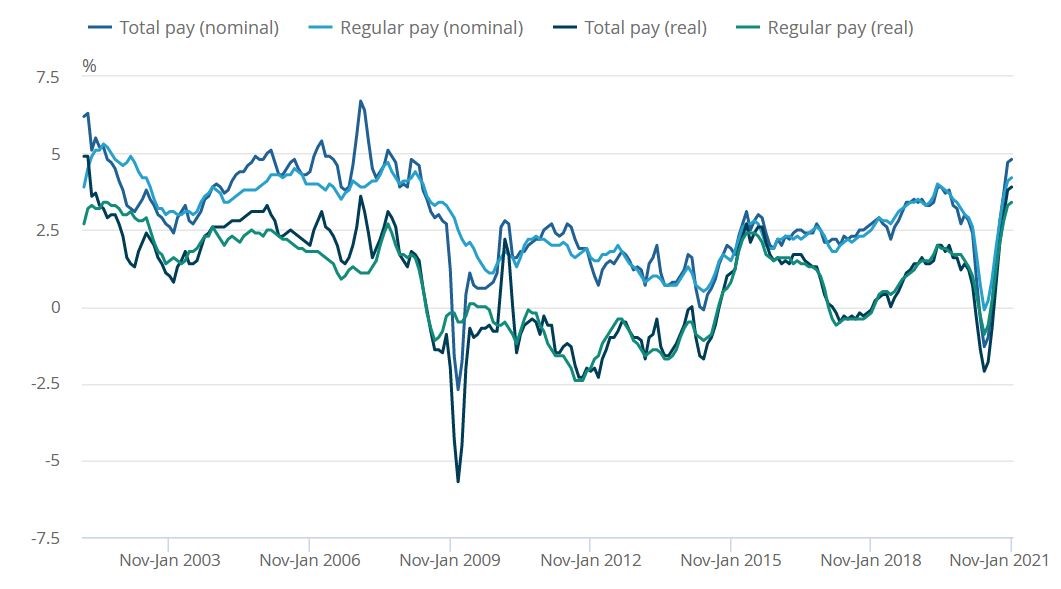

- Earnings continue to grow, driven by bonuses that were previously delayed being paid, as well as a composition impact from a fall in the number and proportion of lower-paid jobs compared with before the pandemic.

For January in nominal terms:

- Average regular pay (excluding bonuses) for employees in Great Britain was £532 per week before tax and other deductions from pay – up from £511 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £572 per week before tax and other deductions from pay – up from £548 per week a year earlier

- In real terms, total pay and regular pay is growing at a faster rate than inflation, at 3.9% and 3.4% respectively in the three month to January compared to a year earlier

Great Britain average weekly earnings annual growth rates, seasonally adjusted, January to March 2001 to November 2020 to January 2021

Source: ONS

Back to Retail Economic News