ONS Labour Market February 2024

Vacancies continue to fall

- The number of job vacancies in November 2023 to January 2024 stood at 932,000, reflecting a decrease of 49,000 compared to the previous quarter, marking the 19th consecutive decrease.

- Vacancies showed a quarterly decline in 12 out of 18 sectors surveyed, with wholesale and retail trade; repair of motor vehicles and motorcycles experiencing a decrease of 13,000, and transport and storage witnessing a decline of 9,000.

- Total vacancies decreased by 209,000 compared to the same period the previous year. Notably, vacancies in human health and social work activities fell by 41,000, and accommodation and food service activities decreased by 37,000.

- Despite the decline, the total number of vacancies remains 131,000 above pre-coronavirus (COVID-19) levels observed in January to March 2020.

Payrolled employees increase on an annual basis

- Early payroll estimates for January show the number of payrolled employees rose by 413,000 employees compared to the previous year (up 1.4%).

- Compared to the previous month, provisional estimates suggest the number of payrolled employees increased by 48,000 (0.2%).

- The largest yearly increase in payrolled employees continued to be driven by the health and social work sector, with a rise of 217,000 employees year-on-year.

Unemployment rate eases

- The UK unemployment rate decreased in October to December 2023 to 3.8%, the same as a year earlier.

Inactivity flat

- The UK employment rate increased in the latest quarter to 75.0% but remains below pre-pandemic levels.

- The UK economic inactivity was largely unchanged in October to December 2023 at 21.9%, but remained above estimates of a year ago.

- The increase was driven by those inactive because of long-term illness, with the number of people inactive due to health reasons reaching 2.8 million by the end of 2023, up 700,000 from before the pandemic.

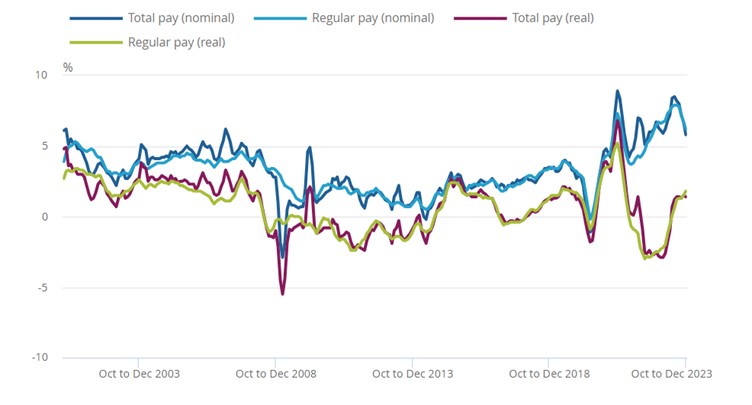

Earnings outstrip price rises

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £626 per week before tax and other deductions from pay in December.

- Average total pay (including bonuses) for employees in Great Britain was £669 per week before tax and other deductions from pay in December.

- Regular pay rose by 6.2% and total pay by 5.8% in the three months to December compared to a year earlier.

- Average regular pay growth in the private sector was 6.2% in the three months to December, while public sector pay rose by 5.8%, reflecting robust growth, albeit weaker than in recent periods.

- In real terms (adjusted for CPIH inflation), regular pay and total pay increased 1.8% and 1.4% YoY respectively in the three months to December.

Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to October to December 2023

Source: ONS

Back to Retail Economic News