ONS Labour Market December 2020

The latest ONS labour market data shows some recovery in hours worked, despite redundancies hitting a record high as hospitality and physical retail remains under intense pressure from Covid-19 restrictions

819,000 fewer on PAYE since March

- The number of paid employees is down some 819,000 in November compared with March 2020 according to flash estimates using PAYE data. However, the largest falls were seen at the start of the coronavirus outbreak.

- Hospitality has been the hardest hit, with 297,000 fewer payroll workers since the start of the pandemic, followed by retail and wholesale down some 160,000 workers.

Hours worked low but recovering

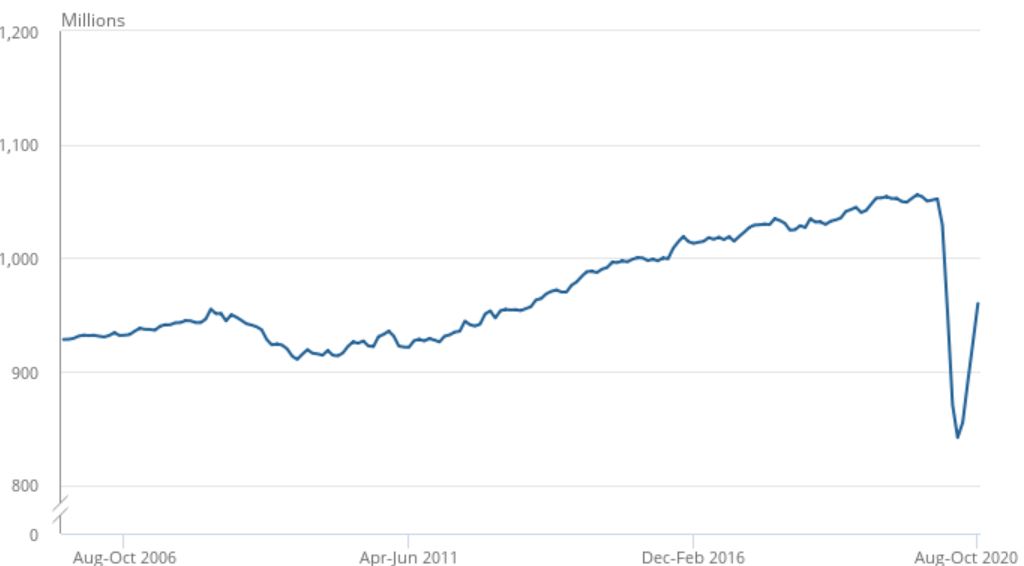

- Although decreasing over the year, total hours worked had a record increase from the low levels in the previous quarter. Total actual weekly hours worked stepped up by 104.9 million, or 12.3%, to 960.0 million hours between August and October as Covid-19 restrictions eased compared to the previous quarter.

UK total actual weekly hours worked (people aged 16 years and over), seasonally adjusted, between August to October 2005 and August to October 2020.

Source: ONS

Hiring continues to rise from low point

- The number of job vacancies continued to recover in the three months to November at an estimated 547,000. This is 110,000 more than the previous quarter but 251,000 fewer, or 31.5% down, compared to a year ago.

- The hotel and catering and retail sector saw the biggest fall in both permanent and temporary vacancies according to the KPMG and REC UK Report on jobs for November.

Employment dips as redundancies hit record high

- The employment rate slowed slightly to 75.2% in the three months to October – 0.5 percentage points down on the quarter and 0.9 percentage points lower than a year earlier.

- This equates to 32.52 million people aged 16 years and over in employment, which is 280,000 fewer than a year earlier and marks the largest annual decrease since January to March 2010.

- The unemployment rate in the quarter to October edged up to 4.9%. This marks a 1.2 percentage point increase on last year and a 0.7 percentage point rise on the previous quarter. The ONS notes the rate had been gradually increasing throughout the three-month period, with the weekly unemployment rate at 5% or above for each of the last three weeks in October.

- The ONS’s experimental claimant count data shows the Claimant Count increased slightly to 2.7 million in November. Since March, the count has increased by 114.8%, or 1.4 million.

- Meanwhile, redundancies increased by a record 217,000 on the quarter, hitting a record high of 370,000.

- Pressure is expected to mount on the retail sector. According to the Business Impact of Coronavirus Survey, 11% of retail and wholesale businesses interviewed between the 19 October and 1 November expected to make redundancies in the next three months – representing the highest rate of any sector.

Annual pay growth strengthens

- Annual pay growth continued to strengthen as more employees returned to work from furlough – but pay growth has also been impacted by compositional effects from a fall in the number (and proportion) of lower-paid jobs.

- In real terms, total pay is now growing at a faster rate than inflation.

For the three months to October:

- total pay (including bonuses) rose by 2.7%

- regular pay (excluding bonuses) increased by 2.8%

Adjusted for inflation:

- total real pay rose by 1.9%

- regular real pay rose by 2.1%

For October in nominal terms (that is, not adjusted for price inflation):

- Average regular pay (excluding bonuses) for employees in Great Britain was £527 per week before tax and other deductions from pay – up from £509 per week a year earlier

- Average total pay (including bonuses) for employees in Great Britain was £560 per week before tax and other deductions from pay – up from £541 per week a year earlier

Great Britain average weekly earnings annual growth rates, seasonally adjusted, January to March 2001 to August to October 2020

Source: ONS

Back to Retail Economic News