ONS Labour Market August 2021

Vacancies hit record high

- The estimated number of vacancies hit a record high confirming the current recruitment difficulties many industries are facing.

- Between May and July, the number of vacancies reached 953,000 with all industries supporting the rise. Notably, there were 3.2 vacancies for every 100 jobs, also a record high.

- Experimental single-month vacancy estimates surpassed 1,000,000 for the first time ever in July 2021.

- Resultantly, vacancies were 168,000 above pre-pandemic levels (the quarter to March 2020).

- Supported by the reopening of the economy, accommodation & food service activities showed the largest increase above pre-pandemic levels up 39.1% (33,000).

- Meanwhile, wholesale & retail trade, repair of motor vehicles & motorcycles was the only industry that had vacancies below pre-pandemic levels. This was predominantly driven by the retail sub sector with vacancies 10,000 lower than their pre-pandemic level.

Employment advances

- Early payroll estimates for the quarter to July show the number of payroll employees rose by 576,000 – or 2.0% – on last year to 28.9 million. However, it remains down by 0.7% since February 2020, marking a fall of 201,000.

- There is regional variation. Compared to a year earlier, changes in payrolled employees in July 2021 ranged from a 3.1% increase in Northern Ireland to a 0.6% rise in London.

- In terms of industry, the increase in payrolled employees compared with a year earlier was largest in the administrative and support services sector (a rise of 212,000 employees) and smallest in the wholesale and retail sector (a fall of 50,000 employees).

- The UK employment rate was estimated at 75.1% in the three months to June, which is 0.3 percentage points higher than the previous quarter, but 1.5 percentage points lower than before the pandemic.

- The increase on the quarter was predominantly driven by an increase in the number of full-time workers, reaching its highest level since pre-pandemic times. Meanwhile, the number of part-time workers increased for the first time since the three months to April 2020.

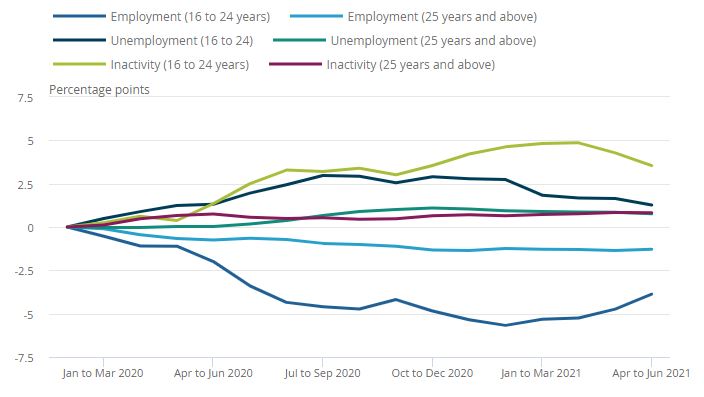

- Data on young people (those aged 16 to 24 years) improved in the three months to June with an increase in the employment rate and a decrease in the unemployment and inactivity rate.

UK economic status rates (people aged 16 to 24 years and 25 years and over), seasonally adjusted, cumulative change from Dec 2019 to Feb 2020 to Apr to Jun 2021

Source: ONS

Unemployment falls

- The latest unemployment estimates show a 0.2 percentage point drop on the previous quarter to 4.7% in the three months to June. This is 0.8 percentage points higher than before the pandemic.

- The quarterly decrease in unemployment was driven by those unemployed for up to 12 months. Elsewhere, the number of short-term unemployed (those unemployed for up to six months) slowed while long-term unemployment (those unemployed for over a year) continued to increase on the quarter.

Hours worked climb

- In the three months to June, as the economy reopened, total actual weekly hours worked accelerated by 50.9 million hours from the previous quarter to 1.00 billion hours.

- This is the first time hours have passed 1 billion since the onset of the pandemic.

- However, this is still 4.8% below pre-pandemic levels.

Earnings rise

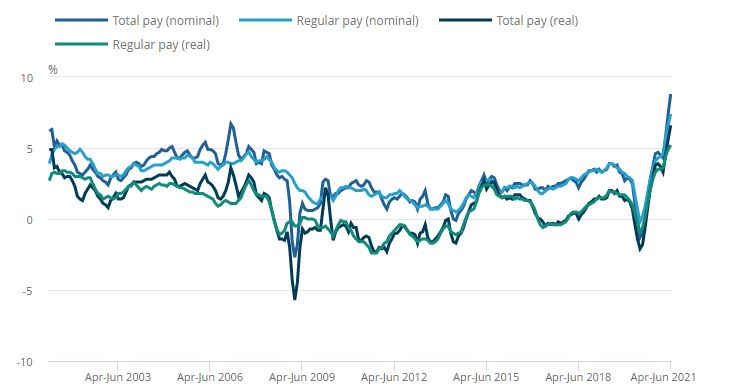

Annual pay continued to increase in the three months to June. In nominal terms:

- Average regular pay (excluding bonuses) for employees in Great Britain was £541 per week before tax and other deductions from pay – up from £505 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £576 per week before tax and other deductions from pay – up from £530 per week a year earlier.

- Regular and total pay growth rose by 7.4% and 8.8% respectively in the three months to June compared to a year earlier.

It should be noted that:

- Annual growth in average employee pay continued to be disrupted by compositional effects from a fall in the number and proportion of lower-paid jobs.

- Additionally, pay growth is being affected by a weak base effect from annual comparisons to the start of the pandemic.

Great Britain, average weekly earnings annual growth rates, April to June 2021

Source: ONS

Back to Retail Economic News