Mortgage Approvals and Lending June 2019 – Bank of England

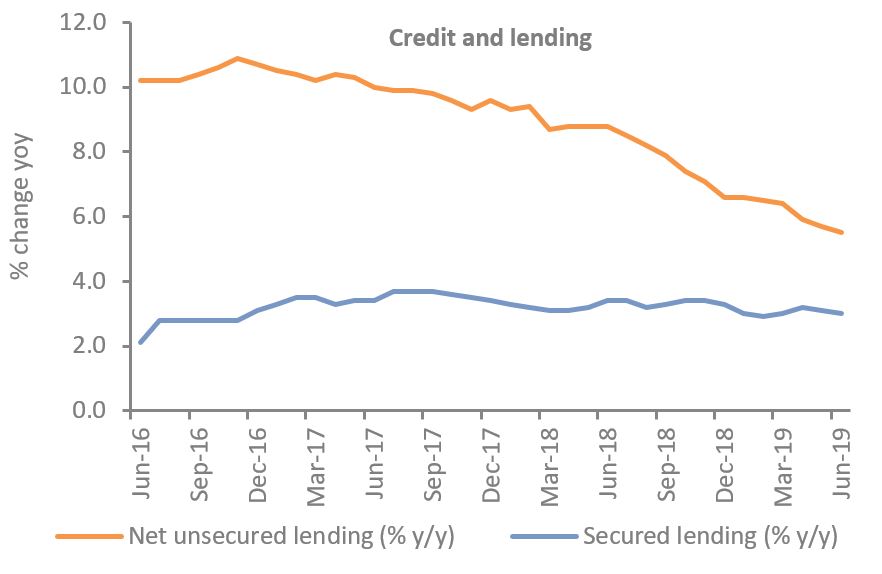

Activity in mortgage markets picked up slightly in June according to the latest Bank of England figures, with the monthly change in the additional amount households borrowed rising to £3.7bn – above the previous six-month average of £3.5bn. The annual growth rate of secured lending remained largely stable at 3.1%.

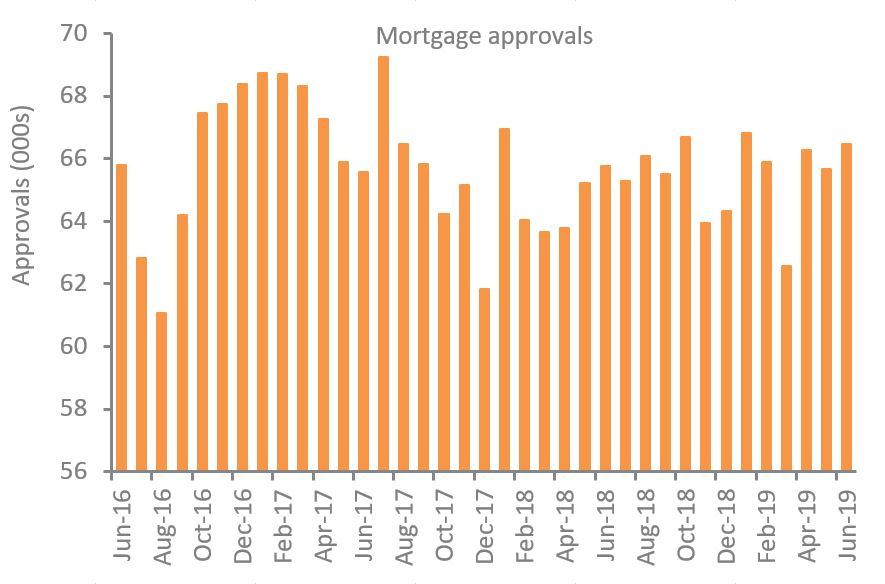

Mortgage approvals rose to 66,440 in June, up from 65,647 last month, which is above the previous six-month average of 65,247.

The number of re-mortgaging approvals moderately rose to 46,976 in June from 46,816 in the previous month. However, this remains below the six-month average of 48,735.

Source: Bank of England

Meanwhile, the additional amount borrowed in net lending to individuals came in at £4.8bn in June, ahead of the previous six-month average of £4.5bn. However, the annual growth rate slipped to 3.4% in the month.

Growth in unsecured lending to individuals slowed to its lowest rate in more than five years in June, falling to 5.5% year-on-year. The actual change in consumer credit was in line with the six-month average at £1.0bn in June.

Borrowing on credit cards also slowed in June, down to 5.1% year-on-year in the month from 5.5% in May. The actual change in the amount borrowed remained at £0.3bn. However, the other loans and advances component edged up in June, with the additional amount borrowed at £0.8bn in the month compared to the previous six-month average of £0.7bn.

Source: Bank of England

Back to Retail Economic News