Mortgage Approvals and Lending July 2019 – Bank of England

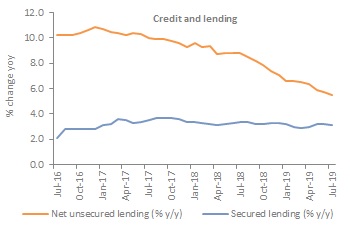

Activity in mortgage markets picked up in July according to the latest Bank of England figures, with the monthly change in the additional amount households borrowed rising to £4.6bn. This was the strongest rise since March 2016 driven by a fall in repayments. That said, the annual growth rate of secured lending remained stable at 3.2%.

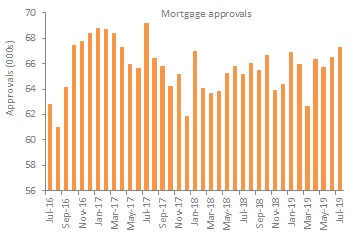

Mortgage approvals rose to 67,306 in July, up from 66,506 in June, which is above the previous six-month average of 65,661 and the highest level since July 2017.

The number of re-mortgaging approvals also rose, albeit marginally, to 47,730 from 47,110 in the previous month. However, this remains below the six-month average of 48,700.

Source: Bank of England

Meanwhile, the additional amount borrowed in net lending to individuals came in at £5.5bn in July, ahead of the previous six-month average of £4.6bn. The annual growth rate remained at 3.5% for the third consecutive month.

Growth in unsecured lending to individuals remained at its five-year low rate in July, rising just 5.5% year-on-year. The actual change in consumer credit dipped to £0.9bn slightly below the previous six-month average at £1.0bn.

Borrowing on credit cards rose 5.3% year-on-year, from 5.1% in June. The actual change in the amount borrowed remained steady at £0.3bn while the additional amount borrowed for the other loans and advances component fell to £0.6bn in July from £0.8bn in June.

Source: Bank of England

Back to Retail Economic News