Halifax House Price Index October 2023

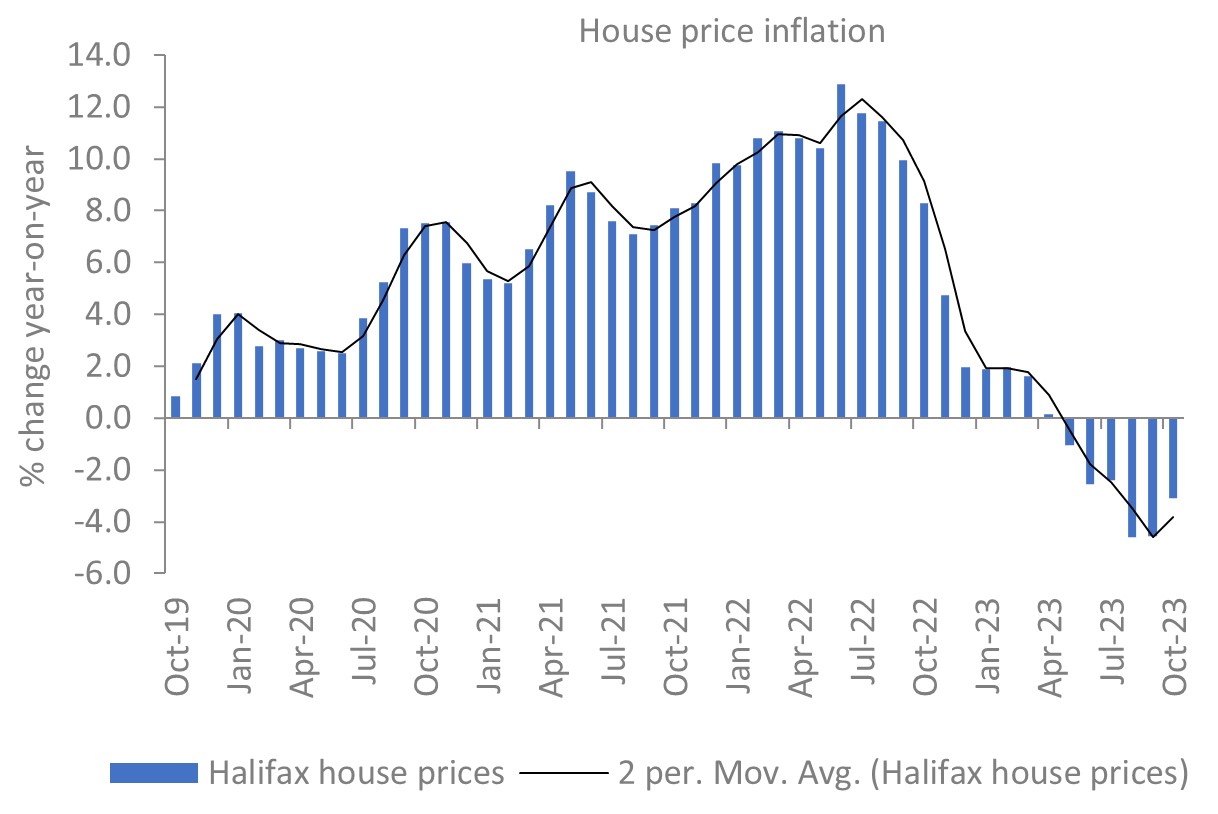

- UK house prices fell 3.2% YoY in October, according to mortgage lender Halifax.

- House prices in the south east of England are under the most pressure.

- Average UK property now costs £281,974, up around £3000 on the previous month.

Annual rate of growth stood at -3.2% in October

Source: Halifax, IHS Markit

Key trends

- Average UK house prices rose in October, increasing by 1.1% MoM, following six consecutive monthly falls.

- The annual rate of house price growth remained negative at -3.2%, but was a slower decline than that seen in September (-4.5%).

- Prices fell on an annual basis in all regions of the UK.

- The South East is facing the most downward pressure, with house prices having fallen by 6.0% on an annual basis to an average of £374,066.

- On the other hand, prices in Northern Ireland and Scotland fell by just 0.5% YoY and 0.2% YoY respectively.

- Despite weakness across the market, demand from first-time buyers remain robust in light of soaring rental prices. Indeed, prices for first time buyers fell by 2.4% YoY, a notably weaker decline than that for the market as a whole.

Outlook

- According to Halifax, the monthly uptick in prices seen in October is primarily the result of low supply of homes due to cautious seller behaviour, rather than being driven by improving buyer demand.

- Although wage growth remained strong in the month, high living and borrowing costs continued to put downward pressure on buyer confidence.

- November saw the Bank of England hold the Base Rate at 5.25% for the second time, but it remains critically high, and a further reduction is not anticipated in the near future.

- This points to further declines in house prices in the months to come, with Halifax expecting a return to growth from 2025.

- It should further be noted that, on average, house prices remain around £40,000 above pre-pandemic levels.

Back to Retail Economic News