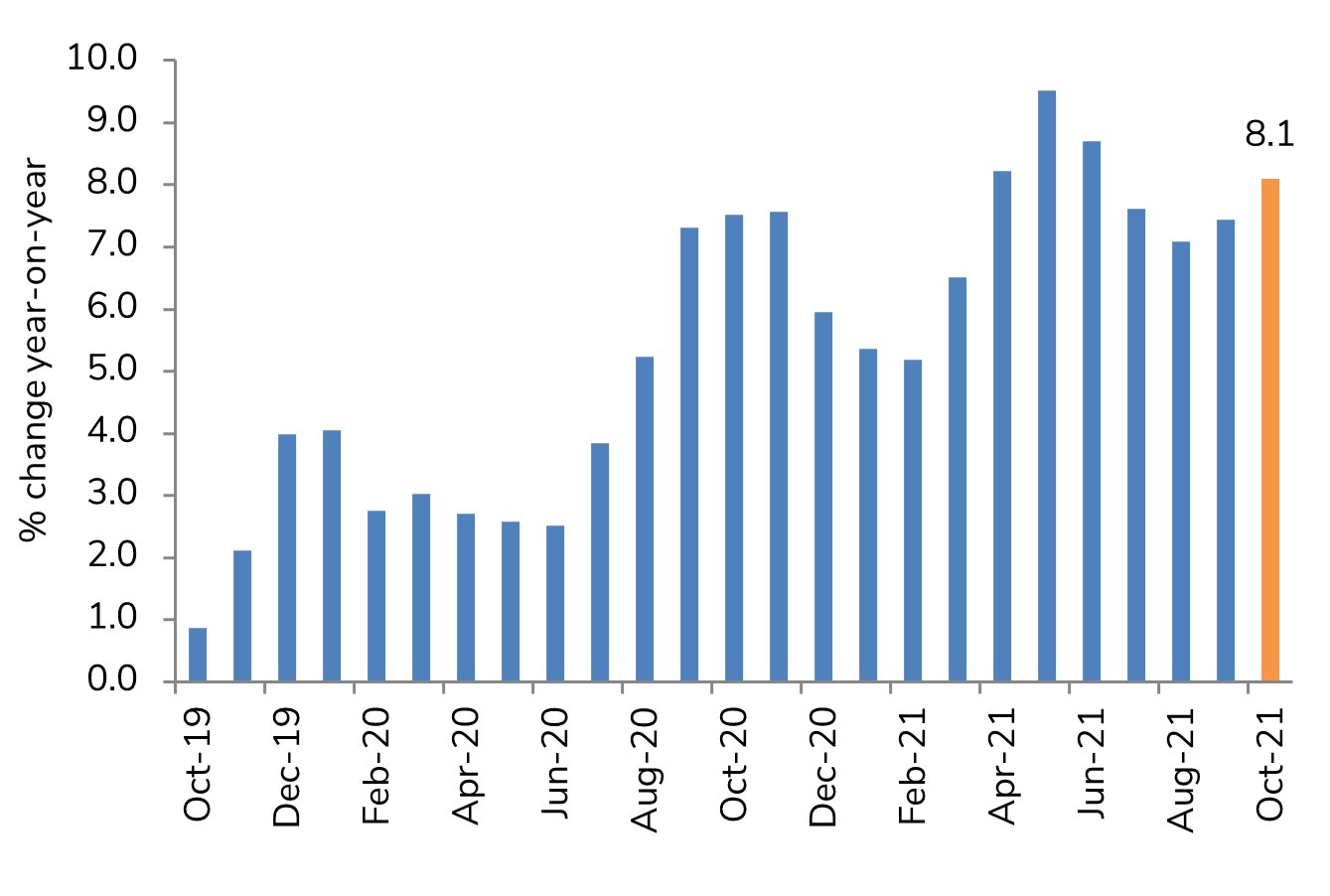

Halifax House Price Index October 2021

- UK house prices rose by 0.9% on a monthly basis in October, and 8.1% year-on-year – the highest annual rate of inflation since June.

- This helped push average house prices to an all-time high, reaching just over £270,000.

- By means of comparison, Nationwide reported that house prices accelerated by 9.9% year-on-year in October and 0.7% month-on-month.

Halifax house price index, year-on-year

Source: Halifax, IHS Markit

Key trends

Demand for homes remains solid, despite the expiry of the stamp duty holiday at the end of September.

Indeed, Bank of England data shows that mortgage applications were robust at 72,645 in September, more than 10% above the monthly average recorded in 2019.

One of the key drivers of activity in the housing market over the past 18 months has been the race for space, with buyers seeking larger properties, often further from city centres. Combined with a lack of homes on the market, this helps to explain why price growth remains robust.

Since April 2020, the first full month of lockdown, Halifax estimates that the value of the average property has soared by £31,516 (13.2%).

First-time buyers, supported by parental deposits, improved mortgage access and low borrowing costs, have also helped to drive price growth in recent months.

First-time buyer annual house price inflation (+9.2%) is now at a five-month high, pushing ahead of the equivalent measure for homemovers (+8.1%).

Outlook

The outlook remains somewhat uncertain. The labour market has outperformed expectations through to the end of furlough, with the number of vacancies high and rising, and unemployment levels holding relatively stable.

If the labour market remains resilient, conditions may stay firmly positive in the coming months – especially as the market continues to have momentum and there is scope for ongoing shifts in housing preferences as a result of the pandemic to continue to support activity.

However, several factors suggest the pace of activity may slow. Consumer confidence has weakened in recent months, partly due to sharp increase in the cost of living and anticipated tax rises.

With the Bank of England likely to react to escalating inflation risks by raising rates before the end of the year, and further interest rate rises predicted over the next 12 months, house buying demand is expected to cool as borrowing costs increase.

That said, borrowing costs will still be low by historical standards, and raising a deposit is likely to remain the primary obstacle for many. The continued limited supply of properties available on the market will also help sustain upward pressure on prices.

Back to Retail Economic News