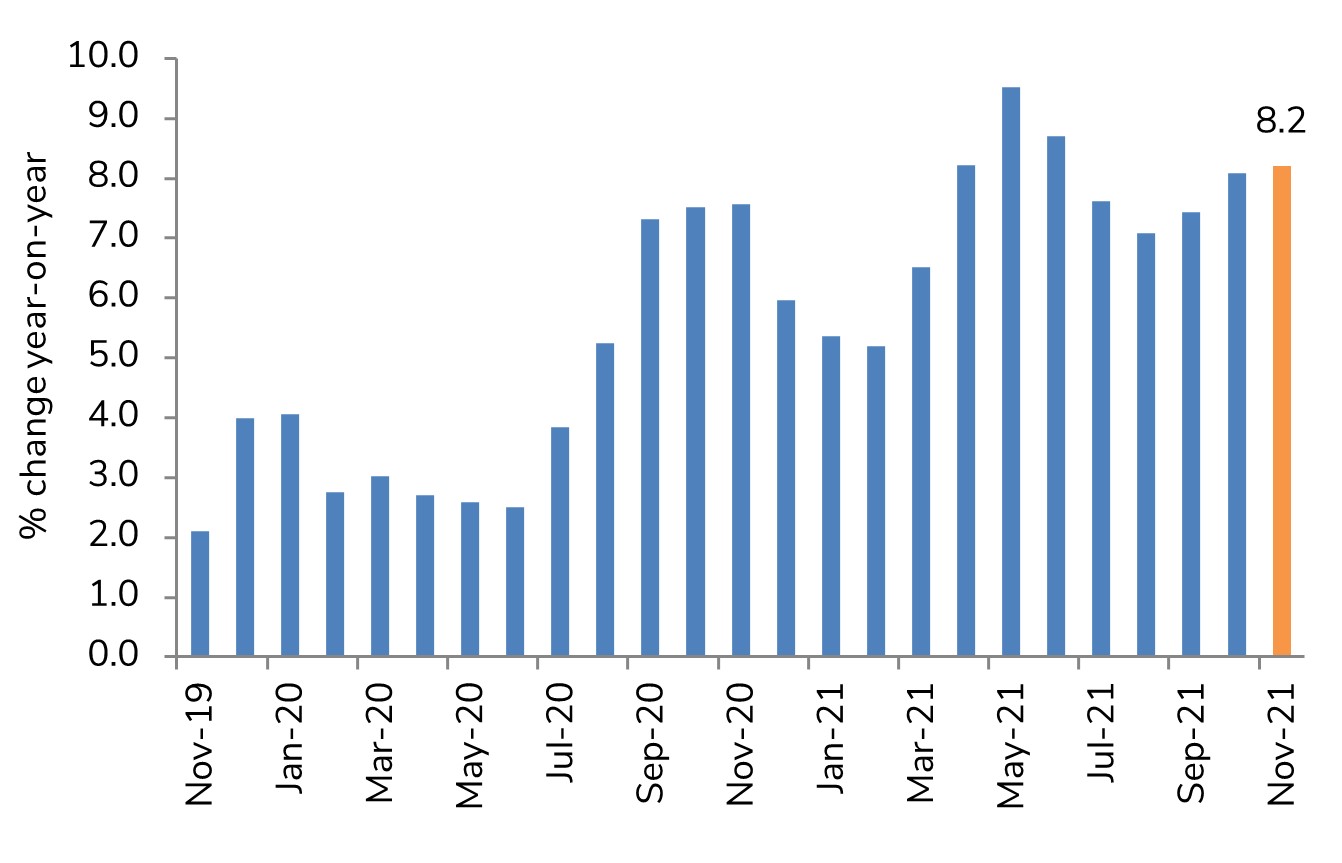

Halifax House Price Index November 2021

- UK house prices rose by 8.2% year-on-year, and 1.0% on a monthly basis, in November.

- House prices reached a new record high once again, averaging £272,992 over the month.

- By means of comparison, Nationwide reported that house prices accelerated by 10% year-on-year in November and 0.9% month-on-month.

Halifax house price index, year-on-year

Source: Halifax, IHS Markit

Key trends

- Annual house price growth remained strong in November at 8.2%, marginally higher than the 8.1% recorded in October. As a result, average house prices are now up by almost £13,000 since June, and more than £20,000 a year ago.

- The performance of the housing market continues to be underpinned by a shortage of available properties, a strong labour market and keen competition amongst mortgage providers keeping rates close to historic lows.

- Those taking their first step onto the property ladder are also playing a key role in driving activity, with annual house price inflation for first-time buyers at 9.1% in November, significantly higher than the overall market growth. Unlike other home movers, first-time buyers continue to benefit from stamp duty relief on property purchases up to £300,000, along with other support schemes.

- House price inflation varies by property types too, with double-digit annual price inflation for flats (+10.8%) in November, compared to slower gains for detached properties (6.6%). This is a marked reversal of the trend seen over the last year and could suggest the ‘race for space’ is becoming less prominent than it was earlier in the pandemic, perhaps as people return to the workplace.

Outlook

- The outlook remains uncertain, with several factors suggesting the pace of activity will slow in 2022.

- The current level of house price growth is unlikely to be sustained next year given that house price to income ratios are already historically high, and household budgets are under increasing pressure.

- It is also unclear what impact the new ‘Omicron’ variant will have on the economy, but any return to restrictions is likely to dampen already fragile consumer confidence.

- Consumer confidence has deteriorated in recent months, largely a reflection of rising living costs. With inflation expected to reach 5.0% in the coming quarters, it is only a matter of time before the Bank of England react to inflationary pressures by raising interest rates, pushing up borrowing costs.

Back to Retail Economic News