Halifax House Price Index August 2021

Average UK house prices reached £262,954 in August, a new record high.

The latest increase came despite incentives for buyers becoming less generous. The market was boosted last year by the stamp duty tax holiday, with the government allowing the first £500,000 spent on a property to be tax free. The tax break was scaled back from July 2021, and the threshold for the stamp duty holiday is £250,000 until September 30.

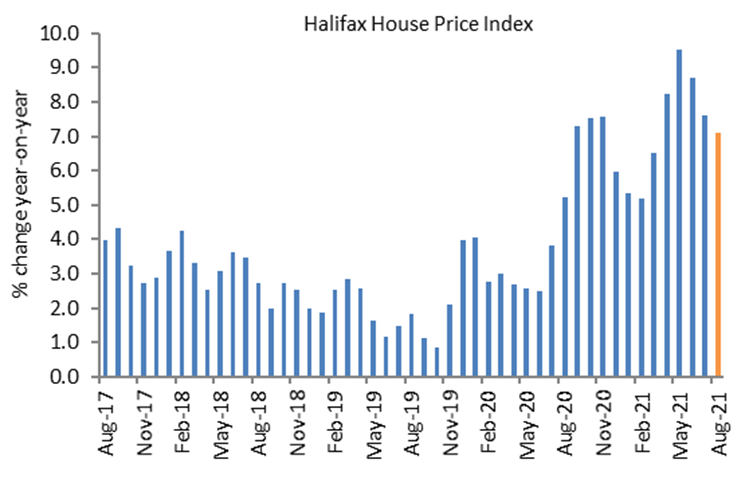

As a result of the stamp duty holiday withdrawal, the annual rate of house price inflation continues to cool compared to the rapid gains seen over the past 12 months. Prices grew 7.1% on a yearly basis in August - a five-month low - and down from 7.6% in July (see chart).

That said, on a month-on-month basis, prices rose by 0.7% in August, which helped to drive the average house price above May’s previous record level.

As a means of comparison, Nationwide reported that house prices accelerated by 11.0% year-on-year in August and 2.1% month-on-month.

Halifax house price index, year-on-year

Source: Halifax, IHS Markit

Data from HMRC shows that the number of house transactions dropped sharply in July, falling by 62% on the previous month to 82,110 transactions (non-seasonally adjusted). This reflects the record number of transactions completed in June as buyers rushed to complete before the stamp duty tax holiday tapered out. Transactions were still up 4.2% year-on-year in July.

Halifax expects the housing market to maintain strength, albeit prices are set to grow at a slower pace than recent record highs. Whilst the temporary stamp duty holiday provided vital stimulus, there are other structural factors that are driving house price inflation that are set to persist. Mortgage rates remain low, the supply of houses for sale remains tight, and buyers continue to want more space amid greater home working.

The macroeconomic environment is also increasingly favourable, with job vacancies at a record high and consumer confidence returning to pre-pandemic levels. Barring any reimposition of lockdown measures or a significant jump in unemployment as job support schemes unwind later this year, these factors should continue to support prices in the near-term.

Back to Retail Economic News