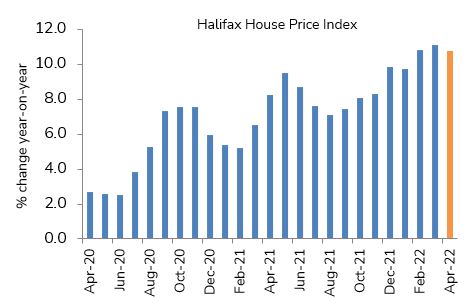

Halifax House Price Index April 2022

- UK house prices rose 10.8% YoY in April according to mortgage lender Halifax.

- Average UK house price reaches a new record high of £286,079

- Average house prices have risen by £47,568 over the last two years

Annual house price growth remains in double-digits

Source: Halifax, IHS Markit

Key trends

- House prices rose for the 10th consecutive month in April (+1.1% MoM), the longest run of monthly rises since 2016.

- Prices continue to be driven higher by an imbalance between demand and supply with growing buyer demand outweighing relatively low housing stock coming onto the market.

- The average house price has accelerated by a staggering £47,568 in the last two years with the national average house price rising to a new record high level of £286,079. Contextually, it took the previous five and half years to make an equivalent jump in prices (+£47,689 between October 2014 and April 2020).

- In terms of different property types, larger properties remain in demand with prices for detached properties rising by more than 12% over the last year, outperforming flats which have risen just 7.1%.

Outlook

- Housing market activity continues to exceed expectations despite the tough economic backdrop.

- Both transactions and mortgage approvals remain above pre-pandemic levels while continued new buyer demand suggests activity will remain robust in the short-term.

- Further ahead, the market is expected to weaken, as rising interest rates and surging inflation exert further upward pressure on household budgets. Worryingly, current pressures have already pushed the house price to income ratio to its highest level on record.

Back to Retail Economic News