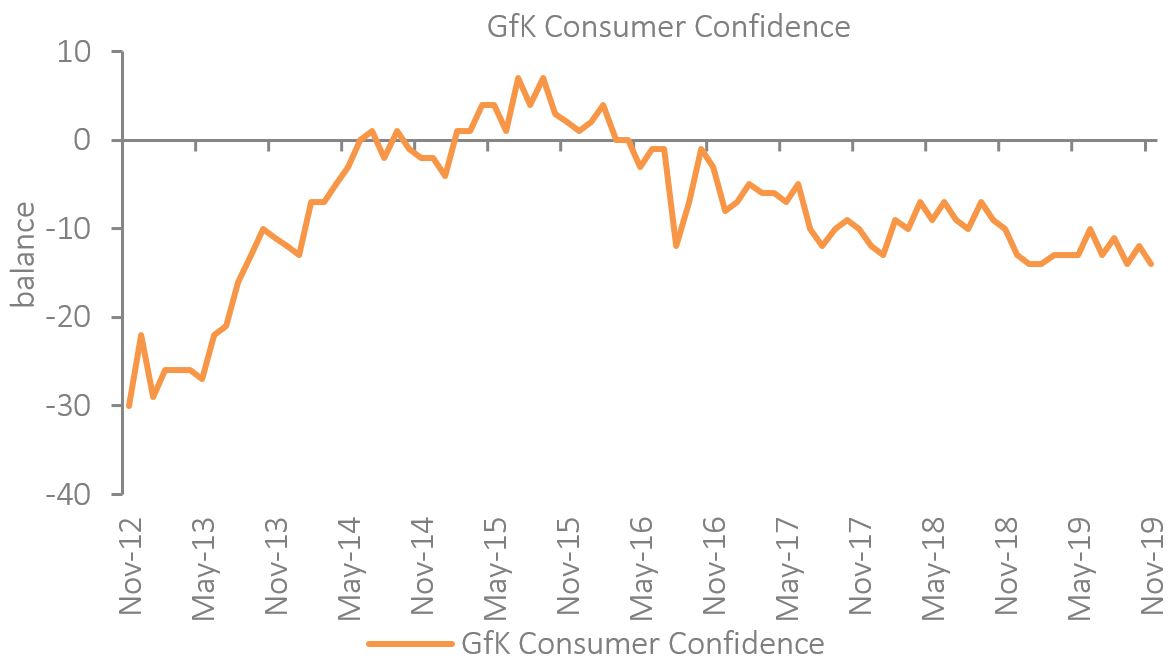

GfK Consumer Confidence - November 2019

Following the announcement of the general election, GfK’s Consumer Confidence measure remained flat at -14 in November, despite a slight pickup in economic expectations for the year ahead.

Three out of the five components in the measure declined in the month. Consumers became more cynical about their recent personal finances, the general economy and their confidence to make major purchases such as furniture and electrical items.

This comes despite household financial positions being stronger than last year, with unemployment at 3.8% and real wage growth hovering at around 2% after 14 consecutive months of increase.

Instead, consumers have become savvier. They’re generally holding off spending on non-essentials until they spot a bargain and believe now is a better time to save compared to a year ago. Given the number of extreme directions politics could take as we head into 2020, this kind of behaviour is likely to drag on over the coming months.

Source: GfK

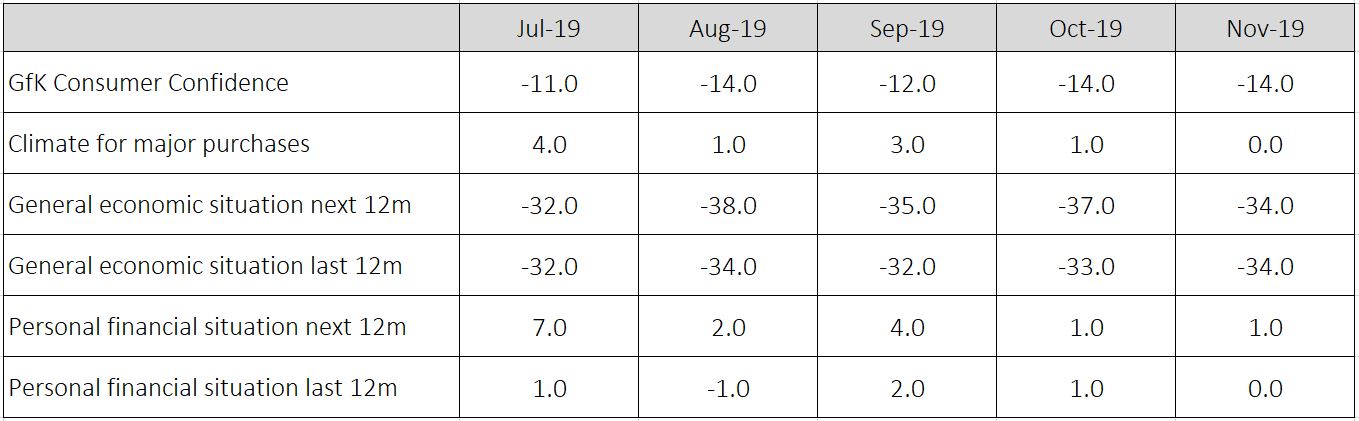

General economic situation

Consumers’ perceptions of the general economic situation over the last 12-months decreased by a point to -34 in November, five points lower compared to last year. The forward-looking component increased three points to -34 – two points lower than in November 2018.

Personal finances

The backwards-looking personal finances component dropped a point to 0 in the month, but is three points higher than last year.The forward-looking measure remained unchanged at +1, which is two points lower than a year ago.

Major purchases

The major purchases index reported a one-point decrease to 0 in November, but is three points higher than a year ago.

Savings Index (not included in the overall measure)

The savings index dipped three points to +18 in November – six points higher than last year.

Source: GfK

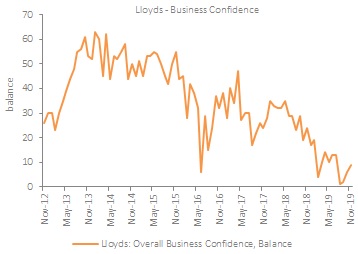

Separate data from Lloyds Bank on business confidence saw an improvement for the third successive month in November. Indeed, the overall measure rose three points to 9%, driven by rising economic optimism with the net balance up nine points to 7%. This outweighed a slight dip in the balance of firms expecting stronger trading prospects which fell two points to 12%.

Interestingly, retail was the most confident sector, with its net balance rising six points to 21%. This compares with 16% for construction, 10% for manufacturing and 4% for services.

Source: Lloyds Bank Business Barometer (November2019), BVA BDRC

Back to Retail Economic News