GDP Q2 2022 Quarterly National Accounts

Headlines

- UK GDP increased 0.2% in Q2 2022 (Apr-Jun), upwardly revised from a first estimate contraction of 0.1%. Economic output remains 0.2% below its pre-pandemic level (Q4 2019), downwardly revised from previous estimates of 0.6% above.

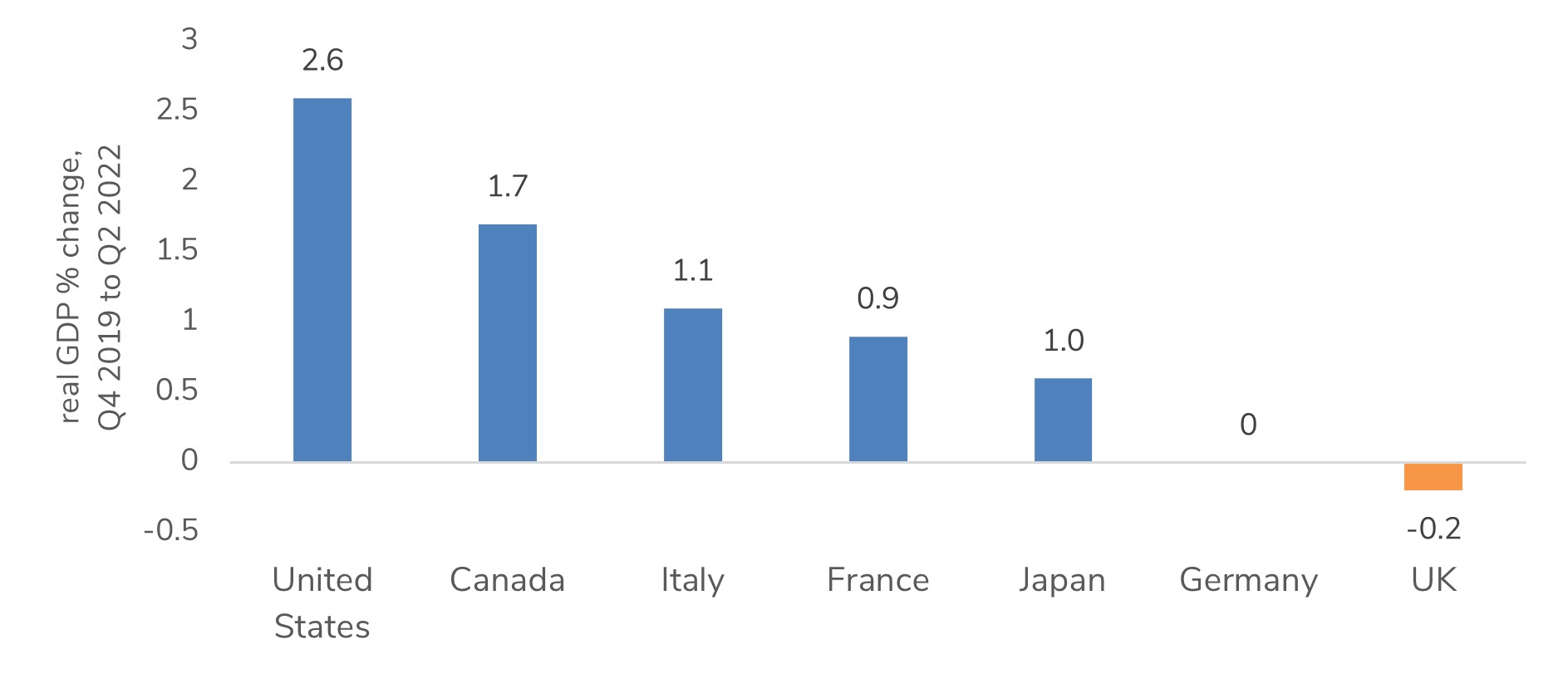

- In real terms, the UK is the only G7 economy yet to recover above its pre-pandemic level in Q4 2019.

- UK GDP is now estimated to have contracted by 11.0% in 2020 and 7.5% in 2021, revised from the previous estimate of a fall of 9.3% and 7.4% growth respectively

The UK is the only G7 economy yet to have recovered to pre-coronavirus levels of real GDP

Source: ONS

GDP breakdown by sector

Services

- The services sector rose by an upwardly revised 0.2% in Q2, compared to an initial estimate of 0.4% decline.

- However, this still represents a slowdown on the first quarter where it increased by 0.8%.

- The revised estimates were driven by positive contributions from human health and social work activities; financial and insurance services; and professional, scientific, and technical activities.

- These partially offset negative revisions to “high-contact” service activities such as retail, accommodation and food services which face a longer recovery from the pandemic than previously estimated. Overall, Services output is now a revised 0.9% below Q4 2019 levels.

Production

- Production output saw a downwardly revised fall of 0.2% in Q2, from an increase of 0.5% at first quarterly estimate.

- This was driven by a 1.1% fall in manufacturing, with notable declines in the manufacture of computer, electronic and optical products; chemicals and chemical products; and transport equipment.

- Anecdotal evidence from the Society of Motor Manufacturers and Traders (SMMT) indicated that ongoing shortages of key components led to car production in the first half of 2022 being weaker than 2009 when the global financial crisis affected demand.

- Production output is now 5.2% above pre-pandemic levels, with manufacturing 4.7% above. Mining and quarrying is the only production industry that remains below Q4 2019 levels.

Construction

- Construction output rose by 1.1% in Q2, revised down from a first quarterly estimate of 2.3%. Overall, Construction output is now 3.2% above pre-pandemic levels.

- Recent new orders in the construction industry data show a 10.4% fall in the latest quarter.

- Anecdotal evidence from the Monthly Business Survey for Construction and Allied Trades (MBS) highlights increased costs of construction materials and the cost-of-living crisis as drivers for the contraction seen in demand.

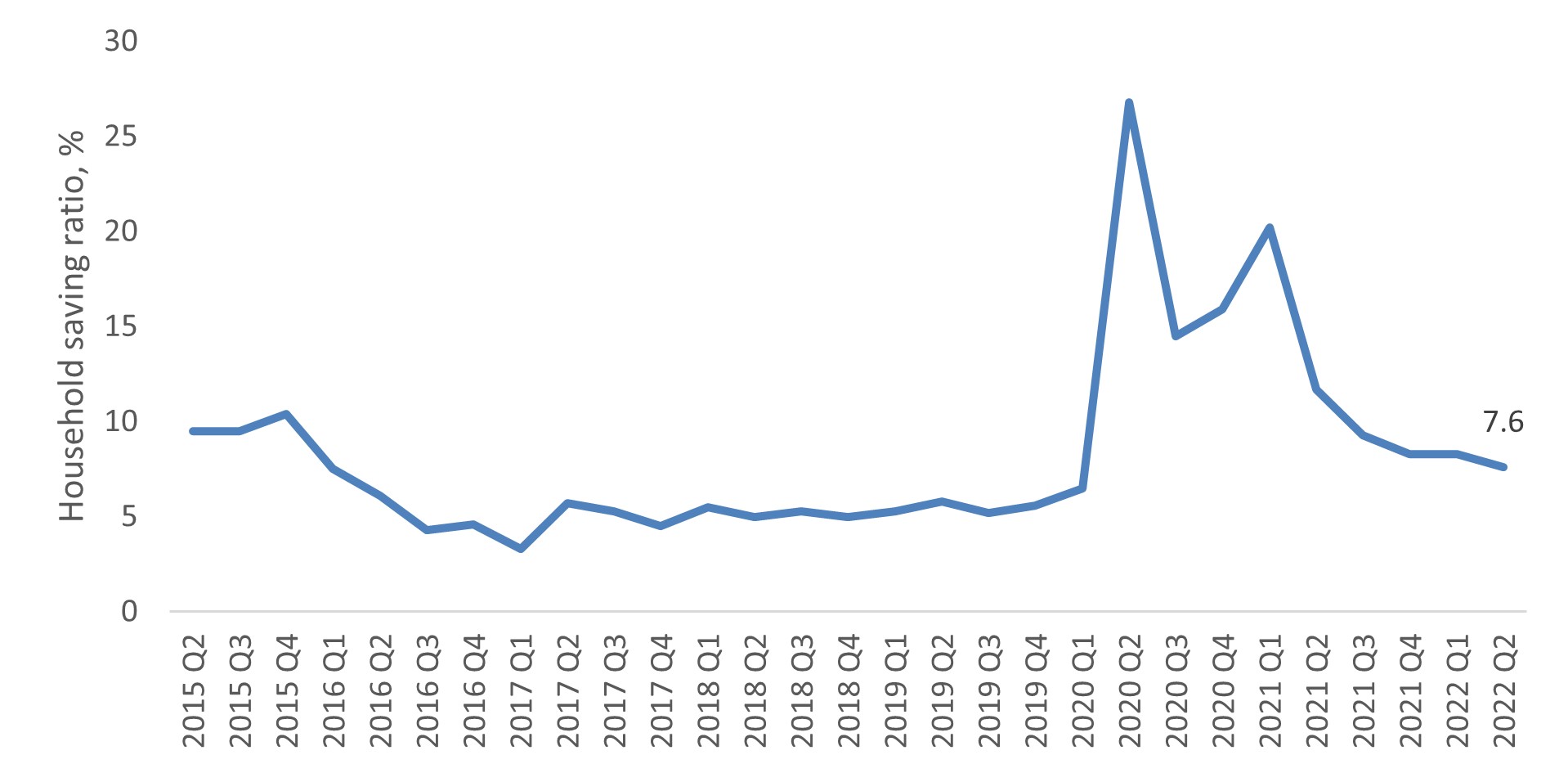

Household saving ratio remains above pre-pandemic level

Household consumption

- In absolute terms, household consumption rose by 3.2% in Q2, but this was largely driven by inflationary pressures on the value of spending.

- The implied price of household expenditure increased by 8.2% when compared with Q2 last year, the highest annual increase since the early 1990s.

- Real household expenditure rose by 0.1% in Q2, upwardly revised from a 0.2% contraction.

- Household saving remains well above the pre-pandemic level, at 7.6% in Q2, compared with 5.6% in Q4 2019.

- Despite household saving remaining higher than before the pandemic, real household disposable income fell by 1.2% in Q2 - the fourth consecutive quarter of real negative growth in disposable income.

Back to Retail Economic News