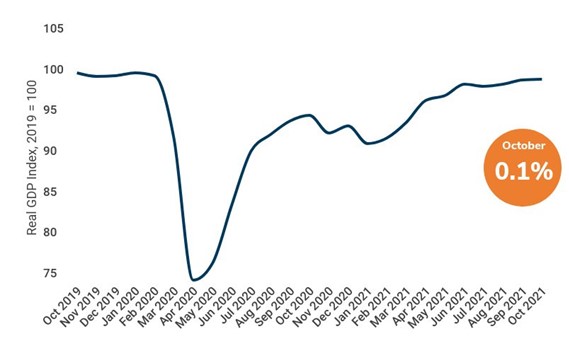

GDP Monthly Estimate: October 2021

UK GDP slowed to 0.1% in October, and remains 0.5% below February 2020’s pre-pandemic level

Monthly GDP index, October 2019 until October 2021, 2019 = 100. Source: ONS

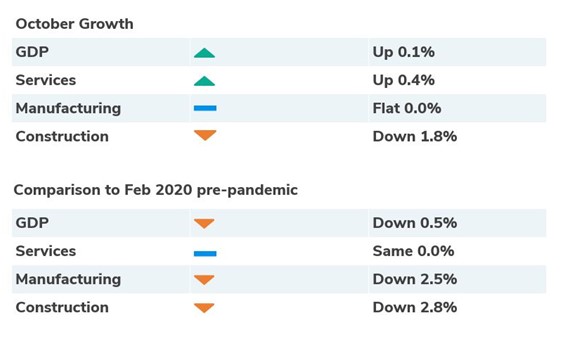

- Gross domestic product (GDP) is estimated to have grown by 0.1% in October, compared to 0.6% growth in September.

- The UK economy remains 0.5% below February 2020’s pre-pandemic levels.

- Health services and second-hand car sales were the key drivers of growth, while supply chain issues hit the construction sector, which suffered its biggest drop since the start of the pandemic.

Services

Services output grew by 0.4% in October, following on from strong 0.7% growth in September. As a result, the sector has now reached its pre-pandemic level for the first time.

Health activities grew by a record 3.5% in October and was the main contributor to growth. This reflects a continued rise in face-to-face appointments at GP surgeries, in addition to the NHS Test and Trace and vaccine programmes, as the UK’s booster roll-out gained momentum.

Consumer-facing services grew by 0.3% in October, driven by an 8.1% increase in the wholesale and retail trade and repair of motor vehicles, as second-hand car sales proved strong after disruption to new car production.

Partially offsetting services growth was a 5.5% fall in accommodation and food services, but this comes on the back of extremely strong growth over the summer when people took to staycations and dining out.

Overall, services output grew by 1.1% in the three months to October. Consumer-facing services remain 5.2% below their pre-pandemic levels, while all other services are 1.4% above them.

Construction

Construction output dropped by 1.8% in October, following 1.3% growth in September. This is the largest fall seen in construction since April 2020.

Construction output recovered to return above its pre-pandemic level in April, but has since dropped back, and now, as of October, is 2.8% below that level.

This reflects recent challenges faced by the construction industry from rising input prices and delays to the availability of products (notably steel, concrete, timber and glass).

Overall, in the three months to October, construction output fell by 1.2%.

Production

Production output fell by 0.6% in October, with electricity and gas down by 2.9%, and mining and quarrying down by 5.0%, while manufacturing saw flat growth.

Production output was 2.1% below its February 2020 level, the last month of “normal” trading conditions prior to the pandemic.

Overall, in the three months to October, production output rose by 0.5%.

GDP Sector Breakdown

Source: ONS

Back to Retail Economic News