GDP Monthly Estimate: July 2022

UK GDP is estimated to have risen by 0.2% in July

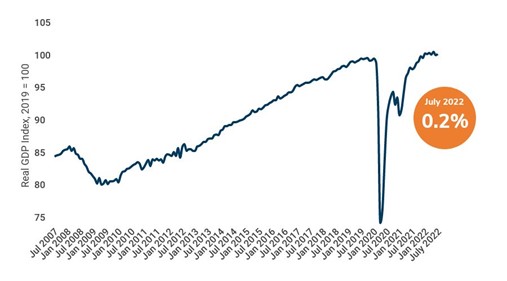

Monthly GDP index, July 2007 until July 2022, 2019 = 100. Source: ONS

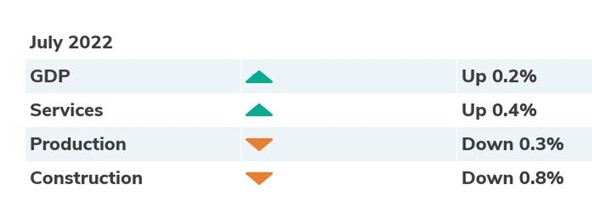

- GDP rose by an estimated 0.2% in July, following a fall of 0.6% in June.

- Monthly economic activity was 1.1% above its February 2020 pre-pandemic level.

- Services grew by 0.4% in July, while Construction (-0.8%) and Production (-0.3%) both declined.

Services (+0.4%)

Services rose by 0.4% in July and was the main contributor to the monthly rise in GDP. This follows a fall of 0.6% in June 2022.

Output in consumer-facing services picked up, rising 0.6% in July, following flat growth in June. Growth was driven by the wholesale and retail trade and repair of motor vehicles (+4.0%), while sports and recreation activities also saw strong growth (+8.1%) as warm weather coincided with the UK hosting both the Commonwealth Games and Women’s Euros.

Growth in consumer-facing services were partially offset by a decline in personal service activities (-4.5%), after continuous growth in this sector since November 2021. Also contributing negatively was buying and selling, renting and operating of real estate (-0.3%).

Overall, services dipped 0.2% in the three months to July 2022, with negative growth seen in 6 of the 14 services sectors.

Construction (-0.8%)

Construction declined 0.8% in July after a 1.4% fall in June. his follows seven consecutive months of growth in the sector between November 2021 and May 2022.

The decrease in monthly construction output in July 2022 came solely from repair and maintenance, which fell 2.6%. This was partially offset by a small rise in new work (0.3%).

High prices for certain construction products, most notably concrete, plaster, bricks, sand, gravel and asphalt-related products, continue to be an issue in the industry. The annual rate of all construction work price growth was 9.6% in June - a record high.

In value terms, construction output is now 17.5% above pre-pandemic levels (Feb 2020), compared with 2.1% above in value terms after removing the impact of inflationary pressures.

Overall, in the three months to July, construction output rose by 1.4% compared to the previous quarter. While still positive, this is the slowest rate of growth in the three-month on three-month series since December 2021.

Production (-0.3%)

Production dropped 0.3% in July, with electricity, gas, steam and air conditioning supply the main cause of negative growth (-3.4%).

Anecdotal evidence from the Department for Business, Energy and Industrial Strategy (BEIS) shows demand for electricity was 2.3% lower in July than a year earlier, suggesting that there may be some signs of households and businesses reducing energy consumption in response to rising prices.

Manufacturing output rose 0.1% in July, with a mixed performance across the sub-sectors. There were growths of 3.3% in manufacture of machinery and equipment, 2.4% in manufacture of wood and paper products, and 1.3% in manufacture of transport equipment. These were largely offset by a decline in the manufacture of basic pharmaceutical products and pharmaceutical preparations (-2.3%).

Overall, production increased by 0.6% in the three months to July, with growth in all four sub-sectors.

GDP Sector Breakdown

Back to Retail Economic News