GDP Monthly Estimate: July 2021

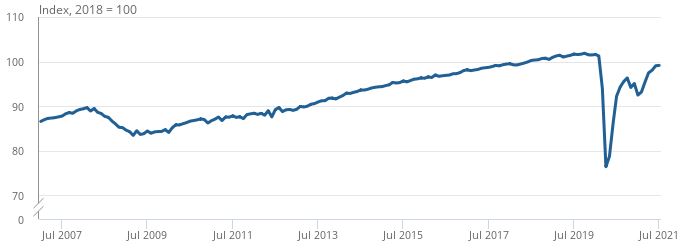

- GDP is estimated to have grown by just 0.1% in July, the weakest growth since January. This was considerably weaker than June (+1.0%) and 2.1% below pre-pandemic levels of February 2020.

- Rising cases of the delta variant and supply chain disruptions hampered activity during the month.

- Production was the main contributor to the rise in GDP, offset by a fall in Construction and flat growth in Services.

- Overall, GDP grew by 3.6% in the three months to July 2021, supported by the services sector.

UK GDP rises for a sixth consecutive month in July, although growth weakest since January

Monthly GDP index, January 2007 until May 2021, 2018 = 100. Source: ONS

Services

The services sector was broadly flat in July 2021, following strong growth in June (+1.5%). The sector remains 2.1% below pre-pandemic levels.

Strong performances from Information and Communication, Financial Services and the Arts and Entertainment and Recreation component supported the rise. The performance within the latter sub-sector was driven by the easing of restrictions on ‘Freedom Day’. This was offset by falls in Professional, Scientific and Technical activities, Human Health and Social Activities and Wholesale and Retail Trade.

Output in consumer-facing services fell for the first time since the start of the year, predominantly driven by the decline within the retail sector. Resultantly, consumer-facing services remain 6.7% below their pre-pandemic levels compared with overall services which are only 0.9% below.

Overall, services output grew by 4.5% on a three-month rolling basis, driven by the reopening of non-essential stores and hospitality as well as increased school attendance.

Construction

The construction sector contracted for a fourth consecutive month in July (-1.6%), driven by delays in product availability and sourcing which pushed up the price of some key construction goods. Growth is now 1.8% below pre-pandemic levels.

The fall in construction output reflected a drop in new work ( -1.1%) and repair and maintenance (-2.4%).

Anecdotal evidence received from the monthly survey suggested that delays in product availability and sourcing caused prices to rise (notably steel, concrete, timber and glass).

Overall, on a three-month rolling basis, construction output fell by 0.6% in July, the first fall in this measure since February 2021.

Production

Meanwhile, Production output increased by 1.2% in July 2021 following June’s fall (-0.7%). The sector is 2.1% below its February 2020 pre-pandemic level.

The largest contributor to the increase in production was mining and quarrying (+21.9%) supported by the reopening of an oil production site.

The Manufacturing sector was broadly flat, following five months of growth. Survey evidence suggests the slowdown was driven by staff shortages as a result of the ‘pingdemic’ as well as lack of EU workers and suitable candidates for jobs.

Production in just 4 out of the 13 manufacturing sub-sectors rose in July with the largest positive contribution coming from the manufacturer of motor vehicles, trailers and semi-trailers. Pressure from the recent shortage of microchips was said to have eased in July.

Overall, in the three months to July, production output increased by 0.4%, led by manufacturing of food and beverage products as hospitality reopened. This was partially offset by a fall in the extraction of crude petroleum.

Back to Retail Economic News