Bank of England Mortgage Approvals and Lending October 2019

Activity in mortgage markets remained stable in October, according to the latest Bank of England figures. The additional amount households borrowed rose by £0.4 billion to £4.3bn, above the previous 12-month average of £3.9bn. The annual growth rate of secured lending was unchanged at 3.2%.

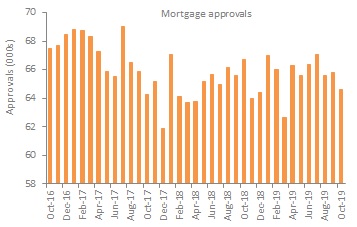

Mortgage approvals fell back to 64,602 in October down from 65,803 in September and below the previous six-month average of 66,087. On an annual basis, approvals fell 3.3%.

The number of re-mortgaging approvals continued to rise, up 51,272 in October from 49,618 in the previous month. This was comfortably above the previous six-month average of 48,423.

Source: Bank of England

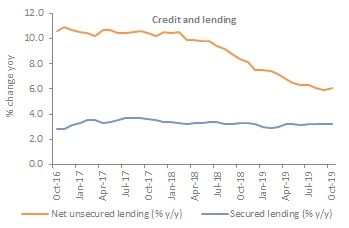

Meanwhile, the additional amount borrowed in net lending to individuals rose by £5.6bn in October. This was above the previous six-month average of £4.9bn, while the annual growth rate was unchanged at 3.6%.

Growth in unsecured lending to individuals rose in October, up 6.1% year-on-year from 5.9% in September. This is the first increase in the annual rate since June 2018.

The actual change in consumer credit rose to £1.3bn, above the previous six-month average at £1.1bn. This was driven by a rise in net borrowing for credit cards and other loans and advances, up £0.4bn and £1.0bn respectively. On an annual basis, credit card borrowing rose by 4.7% year-on-year, while other loans and advances posted a 6.8% rise.

Source: Bank of England

Back to Retail Economic News