Bank of England Mortgage Approvals and Lending May 2020

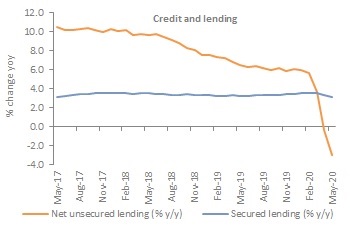

Growth in secured lending remained weak in May, falling to 3.1% year-on-year from 3.3% in April. The monthly change in the additional amount households borrowed rose to £1.2bn, improving on April's no change but considerably lower than the previous six-month average of £4.1bn. The rise was a result of more new borrowing by households rather than lower repayments.

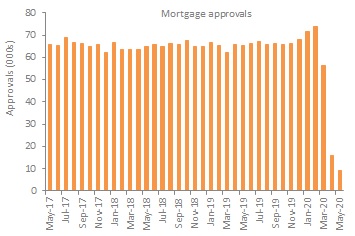

Mortgage approvals fell back further in May as housing market activity remained weak. Indeed, mortgage approvals fell to just 9,273, from 15,851 in the previous month, significantly underperforming the previous six-month average of 58,588. What’s more, this was c.90% below its pre-Covid-19 level and a new record low (series began in 1993). On an annual basis, approvals fell 86%.

The number of re-mortgaging approvals also fell, down to just 30,368 in May from 34,121 in the previous month. This was considerably lower than the previous six-month average of 45,705.

Source: Bank of England

Meanwhile, net lending to individuals fell by £3.4bn in May compared with -£7.4bn in April.

Annual growth in unsecured lending remained in negative territory in May, falling to -3.0% from -0.4% in the previous month – the weakest decline since the series began in 1994. The actual change in consumer credit improved to -£4.6bn, following a £7.4bn net repayment in April.

Most of the repayments were on other loans and advances accounting for £2.8bn of net repayments, while credit cards accounted for £1.8bn. On an annual basis, credit card borrowing continued to decline, down 10.7% year-on-year, compared with a 0.7% rise for other loans and advances.

The smaller net repayment reflected new gross borrowing rising to £13.6bn (from £11.8bn in April), while lower total repayments on consumer borrowing also contributed, falling to £17.7bn from £19.9bn in April.

Source: Bank of England

Back to Retail Economic News