Bank of England Mortgage Approvals and Lending December 2019

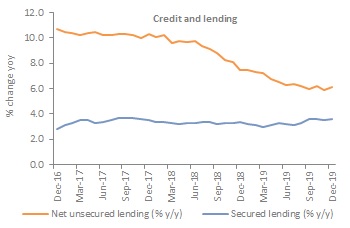

Activity in mortgage markets improved in December, according to the latest Bank of England figures. The additional amount households borrowed rose by £0.4 billion to £4.6bn, above the previous 6-month average of £4.2bn. That said, the annual growth rate of secured lending remained at 3.4% for the second consecutive month.

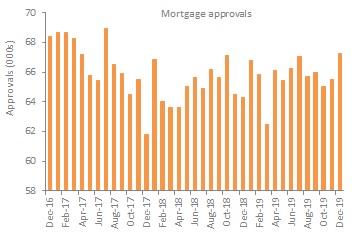

Mortgage approvals rose to 67,241 in December, up from 65,514 in the previous month and above the previous six-month average of 65,918 and higher than the consensus view. This was the highest level since July 2017. On an annual basis, approvals rose 4.6%.

The number of re-mortgaging approvals also improved, rising to 49,680 in December from 48,629 in the previous month. This was above the previous six-month average of 48,865.

Source: Bank of England

Meanwhile, the additional amount borrowed in net lending to individuals rose by £5.8bn in December. This was above the previous six-month average of £5.2bn, while the annual growth rate rose to 3.8%.

Growth in unsecured lending to individuals improved in December up 6.1% year-on-year, from 5.9% in November. The actual change in consumer credit rose to £1.2bn, above the previous six-month average at £1.0bn. This was driven by a recovery in net borrowing on credit cards (up £0.4bn) after debts fell for the first times since July 2013 in November. Net borrowing for other loans and advances rose £0.8bn, unchanged from the previous month. On an annual basis, credit card borrowing rose by 4.5% year-on-year, while other loans and advances posted a 6.9% rise.

Source: Bank of England

Back to Retail Economic News