Bank of England Mortgage Approvals and Lending August 2020

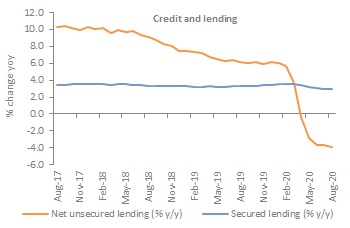

Annual growth in secured lending stabilised in August, rising by 2.9% year-on-year for the second consecutive month. The monthly change in the additional amount households borrowed totalled £3.1bn, improving on the previous month and rising above the previous six-month average of £2.8bn. This increase reflects higher gross borrowing of £18.8bn, which remains below the pre-Covid February level of £23.7 billion.

Mortgage approvals rose to 84,715 in August, up from 66,288 in the previous month and above the previous six-month average of 43,554. This was the sharpest rise in mortgage approvals since October 2007. Interestingly, mortgage approvals totalled 418,000 so far in 2020, compared with 524,000 in the same period in 2019. On an annual basis, approvals rose by 29%.

The number of re-mortgaging approvals remained broadly in line with numbers recorded in recent months, rising by 33,390 in August. This was lower the previous six-month average of 38,771 and 36% lower than the pre-Covid level in February.

Source: Bank of England

Households borrowed an additional £3.4bn of loans in August, slowing on the £3.9bn borrowed in July but above the previous six-month average of £0.6bn.

Annual growth in unsecured lending fell in August to 3.9% year-on-year from -3.6% in the previous month - a new record low. The actual change in consumer credit remained in positive territory for the second consecutive month with an additional £0.3 billion of consumer credit being borrowed.

Net borrowing on credit cards totalled £0.2bn while net borrowing on other loans and advances rose by £0.1bn, both slowing on the previous month. The lower net borrowing reflected gross borrowing increasing by less than gross repayments.

Source: Bank of England

Back to Retail Economic News