UK Retail Sales Report summary

March 2022

Period covered: Period covered: 30 January – 26 February 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales increased by 00% in February against soft comparisons according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel), as the lifting of Covid restrictions collides with heightened inflation expectations. Compared to two years ago, sales were up by 00% in the month.

Coming out of Covid…

The continued easing of Covid restrictions in recent months should have been a cause for celebration, and to some extent it has been. As the UK learns to ‘live with Covid’ from 27 January households saw an end to work-from-home guidance, face coverings in public places and Covid passports; with all remaining Covid restrictions later lifted on 24 February.

This brought the largest single monthly uplift in footfall since June, with footfall rising by 00% in February compared to January (Springboard). Fewer restrictions saw some release of pent-up demand for leisure activities, with spending on travel having its strongest month since the pandemic (00% Yo2Y) according to Barclaycard data.

Opportunities to spend outside of retail freely has dented the performance of previously essential categories such Food (00% YoY) against strong lockdown comparisons.

Greater levels of socialising in February offset turbulent sales during three storms from mid-February in key categories such as apparel. Clothing and Footwear outperformed all other categories as consumers returned to offices and glammed up for Valentine’s Day out this year.

…And into a cost of living crisis

But optimism around living with Covid is being overshadowed by rapidly rising living costs, exacerbated by Russia's invasion of Ukraine and a recent third rise in interest rates in four months by the Bank of England.

Rising supply-side costs and labour shortages have hit consumer baskets hard. Inflation surged to a 30-year high in February at 00% YoY (CPI). This is being driven by staple costs such as energy and transport, as well as previously price competitive categories such as Clothing & Footwear inflation hitting a record high of 00% in February. Such pace is undermining some business models more than others, including fast fashion retailers centred low prices, thin margins and rapid lead times.

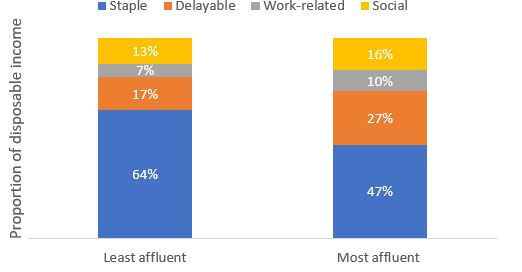

Rampant inflation among staple goods and relatively slow earnings growth is creating a disproportionate impact on the amount of income available for discretionary purchases.

Retail Economics estimates that the least affluent will see discretionary income (after staple and work-related expenses) fall by 00% in 2022. Overall, some £00bn of discretionary spending is set to be eroded this year, which is equivalent to the size of the whole of the DIY & Gardening sector.

The pressure on middle to high affluence households is expected to be cushioned by savings built up since the pandemic. Bank of England estimates show UK consumers accumulated an additional £00bn of savings throughout lockdowns from less commuting, holidays and social activities – which is heavily skewed toward more affluent households.

Take out a FREE 30 day membership trial to read the full report.

The least affluent households spend a disproportionate amount on essentials

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis