UK Retail Sales Report summary

June 2022

Period covered: Period covered: 01 May – 28 May 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales rose by a subdued 00% YoY in May according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted, exc. Fuel). This comes against a backdrop of (1) distortion in annual comparisons, (2) shattered consumer confidence, and (3) evolving consumer behaviour and spending.

Record low confidence as costs rise

Consumer confidence has hit further record lows, impacting willingness to spend as inflation climbs to 40-year highs. Overall consumer confidence declined one point from May to -00 in June according to GfK’s measure – gloomier than in the shocking early stages of the pandemic and even the scarring global financial crisis.

Inflation hit a lofty 00% in May according to the ONS, with the Bank of England warning to expect headline inflation of 00% in the autumn when the energy price cap rises again.

Evolving consumer behaviour

Recessionary behaviour is taking hold across essential purchases such as food. At the same time, budgets for discretionary spending across non-food items are being eroded by higher living costs and a prioritisation to spend on holidays, leisure and recreation as the UK approaches its first summer in three years with no Covid restrictions.

Bank of England data shows that work-related spending (such as fuel and transport costs) have stepped up an eye-watering 00%, as fuel prices continue to hit record highs and hybrid working takes hold. This has eroded discretionary income as take-home pay is not offsetting price increases across such essentials, with the average household seeing their spare cash plummet by 00% in May YoY, leaving them with £00 less to spend on non-essential items according to Retail Economics.

Consumers are trying to be savvy when shopping for essential retail items. Consumers are shopping around for competitive prices to help manage budgets, which has seen an improvement in footfall. Shopper numbers to retail destinations were 00% below 2019 levels in May, compared to being down 00% in April according to Springboard. Conversely, the proportion of retail sales made online edged down to 00% in May – half a percentage point below April.

Non-essential retail is also being impacted heavily by changes in behaviour. Non-food sales recorded its first annual decline in 15 months according to Retail Economics data.

When consumers do spend on non-essentials, they are prioritising social activities and holidays. Data from the Bank of England shows that spending on ‘social’ components of the consumer basket (such as hotels, restaurants and air transport) rose by 00% YoY in May and is 00% above pre-pandemic levels. This is well ahead of overall consumer spending which rose by 5.6%, dragged down by a 00% YoY decline in ‘delayables’ (such as luxury items, household goods and furnishings).

Despite the energy bill grant announced by the government in May for all households, 00% of households feel they still need to reduce their non-essential spending this year.

Against this harsh backdrop, consumer values are set to evolve as shoppers try to maximise perceived benefits across five key value attributes when spending: Price, Quality, Convenience, Experience, and Sustainability.

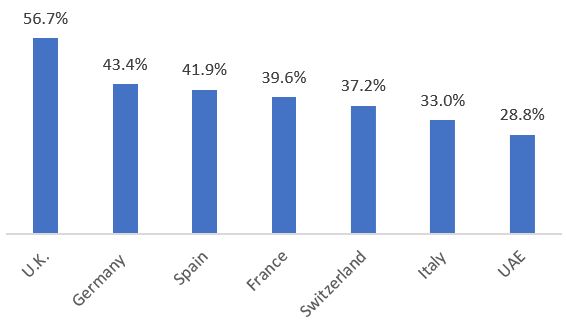

Over the next year, 57% of UK consumers believe the ‘cost of living’ will have the greatest impact on consumers' expectations of retailers – a high compared to its peers.

When buying primarily based on price, 00% of UK consumers will freely switch between online and in-store channels to benefit from cheaper prices.

Take out a FREE 30 day membership trial to read the full report.

Over the next 12 months, what factors do you think will have the biggest impact on your expectations of retail brands? Proportion of respondents who said the “cost of living” could have the biggest impact.

Source: Retail Economics and Alvarez & Marsal

Source: Retail Economics and Alvarez & Marsal