UK Retail Sales Report summary

April 2022

Period covered: Period covered: 27 February – 02 April 2022

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales increased by 00% in March (value, non-seasonally adjusted, exc. Fuel) and lagged behind inflation. Online sales suffered a sharp fall against comparisons to lockdown last year, as the lifting of Covid restrictions and rising living costs see spending priorities shift.

Compared to pre-pandemic levels, retail sales rose by 00% Yo3Ys in March.

Confidence dives

Optimism around the UK’s lifting of Covid restrictions in late February has been tainted by consumer prices surging to a 30-year high (00% CPI).

With the outlook showing that inflation is set to persist and accelerate this year, rising prices are now front of mind for the majority of consumers. April’s Shopper Sentiment Survey by Retail Economics shows that the greatest concern for a high 00% of consumers is the rising price level – up sharply from 00% in January, and well ahead of concerns about Covid, job security and debt.

Channel shift away online

This has resulted in a shift of spending as savvy behaviour takes hold. Online sales fell sharply by 00% in March – partly against tough comparisons to lockdown last year when sales rose 00%, but also as consumers look to bargain hunt in physical environments now that Covid restrictions have been lifted.

Redistribution of spend

Food sales are facing a shift in spend, with sales dropping for a fifth consecutive month in March (00%). Supermarkets are battling for customers, as household budgets come under pressure from inflation and grocers compete for spend against hospitality.

A flight to value is seeing shoppers turn to discount retailers Aldi and Lidl. Both achieved record market shares in the 12 weeks to 17 April, with Aldi’s at 00%, while Lidl is at 00%.

As essential costs rise and the opportunity to spend on services improves, consumer are reprioritising spending. Although retail is seeing cutbacks, pent-up demand is being released for services following two years of restrictions. Social spend, which includes spending on restaurants, pubs and hotels, increased by 00% in March compared to February, and was up 00% on last year as restrictions unwind according to Bank of England data. Barclaycard data also shows that hospitality and leisure saw particularly strong growth in March, rising by 00% on 2019.

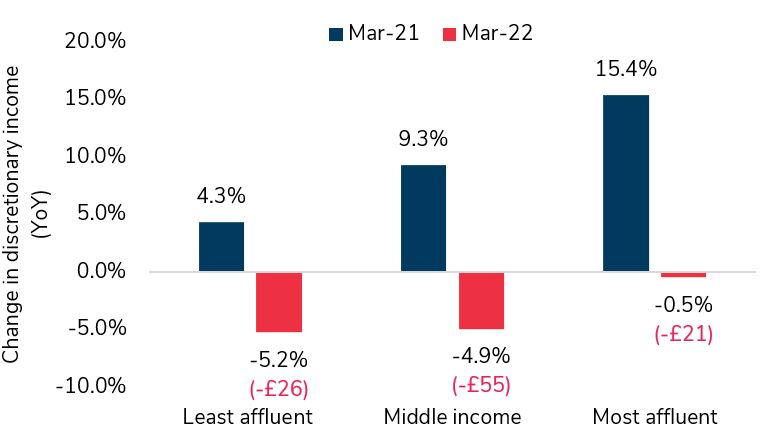

Such spending is likely to be concentrated across middle-high affluent households, who accumulated excess savings during lockdowns, have the prospect of stronger earnings and are facing lower levels of inflation compared to poorer families.

The impact of uneven inflation and earnings growth on discretionary income by household is explored further in this month’s Retail Sales report.

Take out a FREE 30 day membership trial to read the full report.

Spending power of the least and middle income households came under pressure ahead of energy price cap rise

Source: Retail Economics-Hyperjar Cost of Living Tracker

Source: Retail Economics-Hyperjar Cost of Living Tracker